In this section

With over 160 years of history, Poste Italiane has played a key role in the development of the country. For decades, our post offices served as the primary point of contact between citizens, institutions and essential services. Over time, we have gradually evolved our distribution model. For our products, we moved from relying solely on post offices to using digital channels, then to offering third-party products through those same channels, and eventually to leveraging third-party networks and a diverse range of partners for distribution.

Today, our business model is both highly diversified and distinctive. In addition to being a postal and logistics operator, we offer financial, insurance, payment, telecommunications and energy services. These are delivered through a network that combines physical and digital channels in a highly integrated way: 12,755 post offices across the country, a third-party network comprising 49,000 contact points, and our increasingly important digital platforms. In 2024 alone, we recorded more than 25 million interactions per day across all our channels.

For us innovation and digitalization are two central drivers of strategic process and value creation and enable us to guarantee our customers innovative technological solutions, also though the integration of our own products and services with those of third parties.

This makes us a unique presence in Italy in terms of scale, brand recognition and nationwide reach – a fundamental part of the country’s economic, social and industrial fabric.

The value creation process

During 2024, the shared value creation path undertaken by the Poste Italiane Group generated significant results at system level.

This diagram illustrates our value creation process.

It shows how, starting from a range of resources – financial, environmental, social and governance-related – the Group generates both economic and social value for the country.

Through our services, technologies and widespread presence, we transform these resources every day into tangible solutions, positive impacts and measurable outcomes, following a logic of circularity and continuous improvement.

The main financial and Environmental, Social & Governance (ESG) performances achieved by the Group based on the objectives defined on the 8 pillars of the sustainability strategy integrated in the 2024-2028 Strategic Plan “The Connecting Platform” are presented below.

Today, our business model is both highly diversified and distinctive. In addition to being a postal and logistics operator, we offer financial, insurance, payment, telecommunications and energy services. These are delivered through a network that combines physical and digital channels in a highly integrated way: 12,755 post offices across the country, a third-party network comprising 49,000 contact points, and our increasingly important digital platforms. In 2024 alone, we recorded more than 25 million interactions per day across all our channels.

For us innovation and digitalization are two central drivers of strategic process and value creation and enable us to guarantee our customers innovative technological solutions, also though the integration of our own products and services with those of third parties.

This makes us a unique presence in Italy in terms of scale, brand recognition and nationwide reach – a fundamental part of the country’s economic, social and industrial fabric.

The value creation process

During 2024, the shared value creation path undertaken by the Poste Italiane Group generated significant results at system level.

This diagram illustrates our value creation process.

It shows how, starting from a range of resources – financial, environmental, social and governance-related – the Group generates both economic and social value for the country.

Through our services, technologies and widespread presence, we transform these resources every day into tangible solutions, positive impacts and measurable outcomes, following a logic of circularity and continuous improvement.

The main financial and Environmental, Social & Governance (ESG) performances achieved by the Group based on the objectives defined on the 8 pillars of the sustainability strategy integrated in the 2024-2028 Strategic Plan “The Connecting Platform” are presented below.

KEY INPUTS

- Share capital (owned, floating)

- Debt capital

- Expense of the Universal Postal Service

- Postal savings and deposits

- Insurance premiums

- Renewable energy

- Fossil energy

- Materials

- Talent

- Specialist and managerial skills

- Experience

- Integrity

- Health and safety

- Relations with entities and institutions

- Union relations

- Relations with other stakeholders

- Hardware IT infrastructure

- IT software systems

- Properties, post offices, branches and ATMs

- Logistics network

- Integrity and transparency

- Intellectual property rights

- Corporate governance system

Mail, Parcels and Distribution Services

- Universal postal service

- Delivery of mail and parcels

- Delivery of e-commerce products

- Electronic communications

Financial Services

- Collection and management of postal savings

- Asset Management

- Collection and payment service

- Placement and distribution of financial products

ECONOMIC VALUE

Payments and Mobile

- Payments service

- Mobile telephony

- Digital services for the public administration

- Digital services for the Group

- Energy offer

Insurance Services

- Protection of person, property and animals

- Funding protection

- Enterprise multi-risk

- Guaranteed savings and asset management

- Welfare

SUSTAINABLE FINANCE

INTEGRITY AND TRANSPARENCY

PEOPLE DEVELOPMENT

DIVERSITY AND INCLUSION

CREATING VALUE FOR THE COUNTRY

CUSTOMER EXPERIENCE

INNOVATION

GREEN TRANSITION

KEY OUTCOMES

- Revenue

- Assets

- EBIT

- Emissions

- Waste

- Talent

- Specialist and managerial skills

- Experience

- Integrity

- Health and safety

- Partnerships and collaborations

- Collaborative business climate

- Stakeholder engagement

- Accessibility and availability services

- Digitalisation

- Territorial capillarity

- Reputation

- Compliance

- Innovation

Impact generated by the Group

Through its leadership in the logistics, financial, insurance and payment services sectors, Poste Italiane plays a key role in the creation of economic value both for the stakeholders directly impacted by its business activities and for the country as a whole.

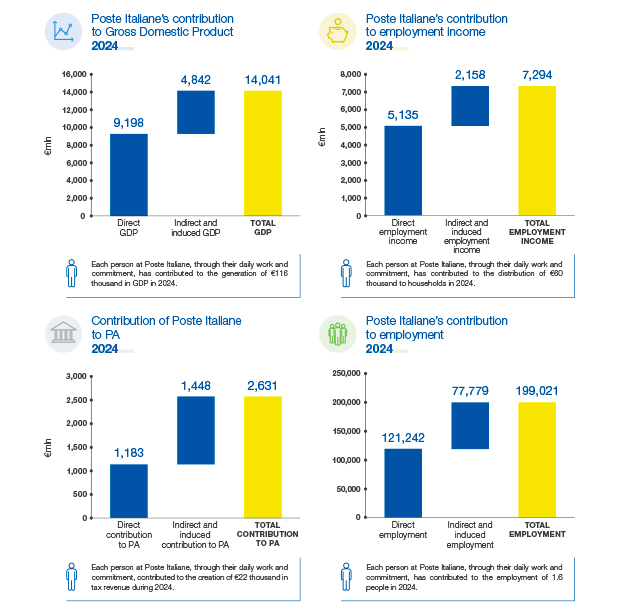

In particular, the activities carried out by Poste Italiane generate impacts on GDP, employment income, employment and contributions to PA. The estimated impacts can be distinguished into:

Through its leadership in the logistics, financial, insurance and payment services sectors, Poste Italiane plays a key role in the creation of economic value both for the stakeholders directly impacted by its business activities and for the country as a whole.

In particular, the activities carried out by Poste Italiane generate impacts on GDP, employment income, employment and contributions to PA. The estimated impacts can be distinguished into:

- Direct impacts: impacts generated by the operating activities carried out directly by Poste Italiane;

- Indirect impacts: impacts generated along the supply chain as a result of Poste Italiane’s spending on goods and services (€3.82 billion in 2024) from Italian suppliers;

- Induced impacts: impacts generated by consumer spending that is realised through the income earned by workers employed directly and indirectly by the Group.

The process of creating Poste Italiane’s economic value

DIRECT IMPACTS

Poste Group

Contributions closely related to the Group's operations in the country

PURCHASES FROM SUPPLIERS IN ITALY

INDIRECT IMPACTS

Suppliers

Contributions generated by businesses thanks to the Group's spending on goods and services

CONSUMER SPENDING IN ITALY

INDUCED IMPACTS

Businesses

Contributions due to the consumer spending thanks to the income earned by the workers employed by the Group. This consists of:

- EMPLOYMENT INCOME

- CONTRIBUTIONS TO PA

- GDP

- EMPLOYMENT

In 2024, the Poste Italiane Group had an impact on the country’s economy, in terms of Gross Domestic Product (GDP), of €14 billion and, employed a total of roughly 199 thousand people and contributed around €2.6 billion in tax revenue to the Public Administration. Furthermore, it is estimated that Poste Italiane contributed directly and indirectly to the distribution of income to workers, totalling €7.3 billion.

Poste Italiane’s creation of value is based on the contribution that the Group’s individual people make through their daily work and commitment. Indeed, during 2024, each Poste Italiane person contributed to the creation of economic impacts for the territory amounting to €116 thousand of GDP, €60 thousand of income for families, €22 thousand of tax contributions and the employment of 1.6 people.

Poste Italiane’s creation of value is based on the contribution that the Group’s individual people make through their daily work and commitment. Indeed, during 2024, each Poste Italiane person contributed to the creation of economic impacts for the territory amounting to €116 thousand of GDP, €60 thousand of income for families, €22 thousand of tax contributions and the employment of 1.6 people.

One euro spent by Poste Italiane for the purchase of goods and services generates an economic value for the country system of €3 in terms of production value.

The figures shown have been rounded off for ease of reference. For this reason, the sums may differ slightly from the reported figures.

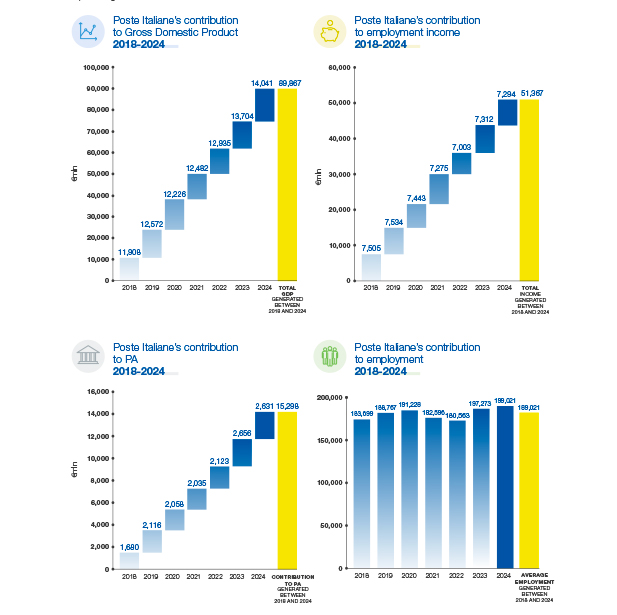

The commitment that Poste Italiane dedicates to serving the country’s economy is not limited to 2024, but is embedded in a path of annual value creation. In fact, from 2018, Poste Italiane Group generated total impacts for the Country of approximately €90 billion of Gross Domestic Product (GDP), €51 billion of employment income and €15 billion of tax revenue. In addition, the Group contributed an average of 189 thousand jobs between 2018 and 2024.

The figures shown have been rounded off for ease of reference. For this reason, the sums may differ slightly from the reported figures.

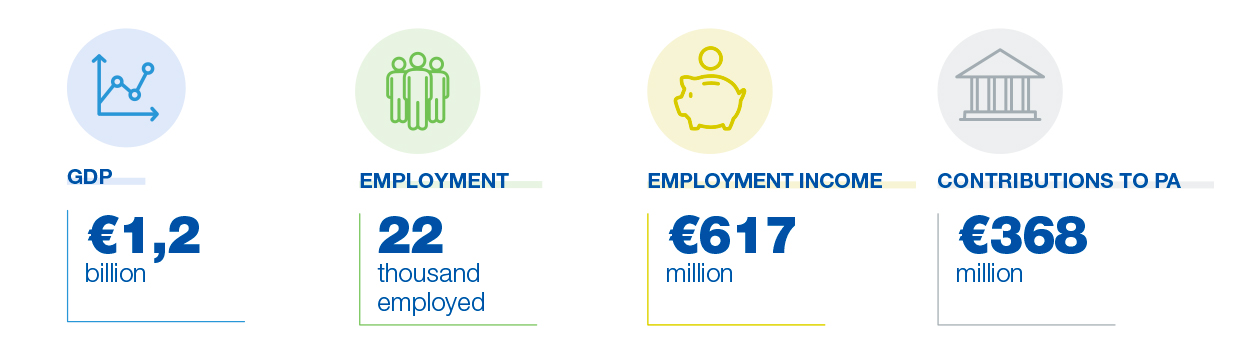

Impacts of Italian SME suppliers

Considering the parameters defined by the European Commission, the Italian suppliers that are characterised as Small and Medium Enterprises (SMEs) and the indirect impacts attributable to them have been identified.

In 2024, SMEs impacted the level of Gross Domestic Product for a value of €1.2 billion, leading to the employment of roughly 22,000 people and an income distribution of €617 million. Finally, €368 million has been generated in terms of tax revenue.

Creating value for shareholders and employees

Our activities allow us to create value for our shareholders through dividends investing in Poste Italiane means investing in the largest service distribution network in Italy.For our employees, we create value not only through employment, but also through our many initiatives to develop human capital

2024 highlights:

- Poste Italiane is Top employer for the 6th year running

- Strengthening of the corporate welfare platform

- 6 million hours of training delivered

- Enhancement of coaching activities and evolution of the Mentoring programme