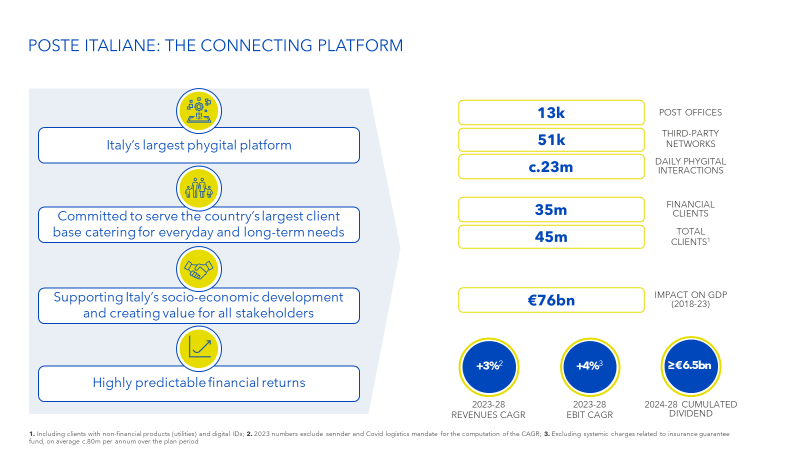

An anti-fragile, platform company and the largest phygital platform in Italy, thriving on the integration of multiple touchpoints and creating an omnichannel ecosystem where each portion of the platform complements the others. Financial stability, an increasingly sustainable business model and a generous dividend policy are fundamental values.

12,755 Post Offices in every corner of the country, often where no other trusted institution can be found.

Around 49,000 third-party network touchpoints lead to almost 25 million daily interactions with our 46 million clients.

Poste Italiane's business extends far beyond traditional postal services. With diversified revenue streams in financial services, insurance, logistics, payments, mobile and broadband connections as well as a retail gas and electricity offer, we have built a robust product that mitigates risks associated with fluctuations in any single sector. This diversification ensures steady revenue generation and shields the company from economic downturns.

1. Includes direct and indirect employment;

2. % of the population within 5 min. (or 2.5km) of a Pick-Up & Drop-off point (incl. Post Offices);

3. Adjusted excluding systemic charges related to insurance guarantee fund (€74m for 2024) and costs and proceeds of extraordinary nature (€341m for 2024 of extraordinary costs related to tax credit Voluntary Risk Assessment “VRA”)

Trends

The megatrends influencing Poste Italiane are shaped by a complex global context marked by several significant factors – including technological innovation and artificial intelligence, environmental sustainability, demographic and social shifts and the evolution of payment systems – by embedding them into its strategy to ensure resilience, sustainable growth and long-term value creation.

|

Megatrend |

Strategic Drivers |

Strategic and Financial Achievements |

|

Artificial Intelligence |

Digital infrastructure, Ethical AI, Generative voice |

Productivity gains, cost reduction, improved retention and new revenue growth |

|

Environmental Sustainability |

Renewable energy procurement |

Emission reduction, green finance access, elevated ESG positioning |

|

Demographic & Social Changes |

Tailored offerings, Social welfare, territorial integration |

Revenue growth across demographic segments, enhanced social capital and loyalty |

|

Payments Evolution |

PostePay Ecosystem |

Expansion of digital revenues, platform efficiency now encompassing telco and retail energy offer, broader financial and insurance inclusion |

AI is rapidly becoming a critical enabler of transformation — from finance and risk management to supply chain optimization and customer service. Its ability to extract actionable insights from unstructured data improves decision accuracy and operational agility. As regulatory frameworks begin to define standards for ethical and responsible AI use, companies that invest early in governance and transparency will gain a strategic edge in stakeholder trust and compliance readiness.

Strategic Response

Poste Italiane is advancing its digital infrastructure while promoting the inclusive and ethical use of artificial intelligence to enhance service quality and long-term sustainability.

Infrastructure Investments

The Group is strengthening its Cloud and Edge Computing capabilities to support a national-scale omnichannel platform currently managing 25 million customer interactions per day.

Responsible AI

An AI Ethics Manifesto has been developed to guide the deployment of artificial intelligence in a transparent, accountable and sustainable manner.

Personalised Customer Experience

The Poste Italiane SuperApp leverages AI-based customer segmentation and real-time behavioural triggers to deliver hyper-personalised experiences, both reactively in customer support and proactively through marketing campaigns.

The global shift toward decarbonization has positioned sustainable mobility as a core component of long-term environmental strategy. Electrification of transportation networks and optimization of delivery fleets are key levers in reducing greenhouse gas emissions. Green fleets support air quality improvement, lower operational costs over the long term, and align with climate neutrality targets, especially in urban environments.

This transition is reinforced by regulatory frameworks (EU Taxonomy), public investment incentives, and increased investor focus on emissions. Companies that lead in sustainable mobility are better positioned to access ESG capital, mitigate regulatory risks, and build resilient infrastructure.

The shift is particularly evident in sectors such as logistics, energy, and transportation, where electrification of fleets, clean energy procurement, and emissions reduction plans are driving operational transformation. These actions not only reduce environmental footprint, but also improve cost efficiency, resilience, and regulatory compliance. Sustainability is thus evolving from a compliance-driven requirement into a source of competitive advantage and long-term value creation.

Strategic Response

Poste Italiane is actively pursuing logistics decarbonisation and prioritising the procurement of renewable energy to align operations with national and EU sustainability objectives.

Fleet Renewal Plan

Since 2019, the Group has implemented a systematic replacement of its delivery fleet with electric and hybrid vehicles, making it one of the largest users of electric utility vehicles in Italy.

Operational Efficiency & Safety

The introduction of new vehicles enables a reduction in energy consumption, an increase in load capacity and an improvement in road safety standards.

The rise of contactless, mobile, and instant payment solutions reflects a move toward frictionless, secure, and data-rich transactions. This megatrend fosters financial inclusion, enhances transaction efficiency, and opens new opportunities for innovation in financial services and beyond.

Moreover, the shift toward cashless economies enables stronger anti-money laundering compliance, real-time data monetization, and the development of embedded finance models. Payment infrastructure is becoming a strategic asset in the broader platform economy.

Strategic Response

Poste Italiane is building a unified digital ecosystem and expanding access to inclusive cashless services to support Italy’s digital and financial transformation.

SuperApp & PostePay Ecosystem

Through an integrated platform that brings together cards, wallets, and digital banking, the Group enables a secure, personalised, and inclusive transition to a cashless economy, with AI powering customer-centric functionalities.

Cashless Acceleration

The adoption of digital payments is promoted across all customer segments, including those traditionally underserved, increasing transaction security and reducing dependency on physical cash.

Market overview by business area

In particular, for the mail segment, a further structural market decline in volume terms is estimated in 2024 (-5.9% compared to 2023, compared to a slight increase in value of +1.2%).

Within the parcel business, the growth trend in overall market value continues in 2024, with an expected increase in revenue of around 4% compared to 2023.

The logistics market in Italy is seeing steady growth in the outsourcing of logistics services by industrial and commercial operators to specialised entities capable of covering the entire value chain. In particular, the market for Integrated Logistics Services in 2022 will be worth around €13.6 billion, up 14% year-on-year. A lower level of growth is estimated for 2024 (+2.8%) compared to last year (+6% in 2023 compared to 2022). A further slowdown in growth is expected in 2025. The market, although very competitive, is relatively fragmented. However, some concentration phenomena have taken hold, typically stimulated by major industrial players seeking integration synergies between the different stages of the supply chain.

The energy market in 2024 was characterised by the full liberalisation for gas as of 10 January 2024 and electricity as of 1 July 2024. The operators, through targeted promotions and communication campaigns, tried to steer as many potential customers onto their free market offer, also soliciting those who had already made this choice in the past, resulting in higher switch rates.

The gas market, given the strong growth in the trade of Liquefied Natural Gas (LNG) by ship, has increasingly taken on an international scale, guaranteeing greater diversification and at the same time being influenced by the international geopolitical and economic context, which also in the second half of 2024 remained complex due to: the various wars and tensions (Ukraine, Israel, Syria, Iran, etc.), the uncertainties linked to the evolution of Asian energy demand and the trade dynamics between the United States of America and the rest of the world. In addition, during 2024, weather phenomena proved to be important factors in the volatility of gas and electricity prices in the European market, such as winter cold spells or summer heat waves, wind intensity for wind power plants, availability of water in reservoirs, etc., as a result of the increasing contribution of renewable sources in the energy mix, sources that are linked to the variability of weather conditions.

Macro-economic evolution with a mix of mild inflation, stable and slightly lower rates is creating a benign environment for growing savings and investments fees and improving visibility on our investment portfolio revenue stream.

Clients are changing habits when dealing with financial transactions and management of their wealth so it’s necessary to develop an omnichannel service model to address these changes for instance, our SuperApp will help clients to have seamless experiences with Poste Italiane and ensure we have everything they want in one place.

At 31 December 2024, the lapse rate was 6.6%, up from 4.4% at 31 December 2023, and significantly lower than the market lapse rate recorded at 31 December 2024, which was 10.39%.

As regards the protection products market, the total premiums of the Italian direct portfolio, thus including the production carried out in our country by Italian companies and the representations of foreign ones, based on the latest official data available, amounted to € 35.5 billion at the end of September 2024, an increase of 8.8% compared to the same period in 2023, of which € 14.1 billion related to the motor protection sector, €19.7 billion to the non-motor protection sector and the remainder (€ 1.7 billion) to premiums from Life protection products.

As far as distribution channels are concerned, the agency channel remains the leader with a market share of 71.0% at the end of September 2024 (equal to the figure recorded at the end of the first quarter of 2023).

Poste’s strengths

2024 Adjusted EBIT c.3X 2017 EBIT – Net profit 2 years ahead of plan

We have demonstrated our nature of being a truly antifragile company: we have always adapted to a rapidly evolving operating context, transforming challenges into opportunities.

Through strategic initiatives, operational efficiency and customer-centric innovations, Poste Italiane consistently delivers strong financial results, driving shareholder value and market outperformance.

In 2024 we posted a record revenue of € 12.59 billion, record adjusted EBIT at € 2.96 billion, almost three times the 2017 level and net profit at € 2 billion, two years ahead of plan and fully aligned with our updated guidance.

Poste Italiane has consistently exceeded market expectations, demonstrating its ability to outperform amid evolving market conditions.

2024 Adjusted EBIT1 c.3X 2017 EBIT – Net Profit 2 years ahead of plan2

Strong Adjusted EBIT growth driven by steady revenue progression and operating leverage

| 2017 | 2023 | 2024 | 2017/24 CAGR | |

|---|---|---|---|---|

| Revenues 3 |

|

|

|

|

| Adjusted Ebit 1 |

1.12

|

|

|

|

| Net profit |

0.69

|

|

|

|

| DPS (€) |

0.42

|

|

|

|

| Achieved |

|

1. Adjusted excluding systemic charges related to insurance guarantee fund (€74m for 2024) and costs and proceeds of extraordinary nature (€341m for 2024 of extraordinary costs related to tax credit Voluntary Risk Assessment “VRA”);

2. 2024-2028 Strategic Plan “The Connecting Platform” presented in March 2024;

3. Revenues are restated net of commodity price and pass-through charges related to the energy business. 2017 revenues are restated net of interest expenses and capital losses on investment portfolio.

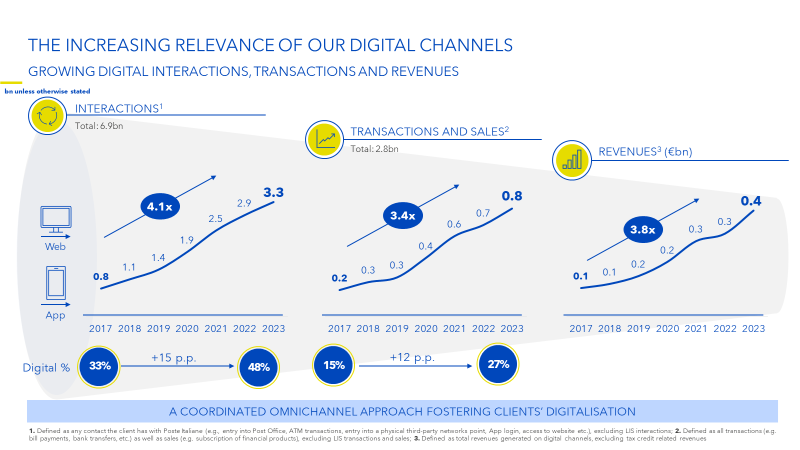

Accelerating digital journey to enhance platform effect

In 2024, we managed more than 25 million daily customer omnichannel interactions across our platform, totalling 8 billion interactions.

Digital clients continue to grow, reaching 18 million, with digital channels accounting for around 30% of our total transactions and sales.

At the same time, we further improved our customer-experience-index by almost 12 percentage points since 2017, to 35.4%.

Expanding the hybrid client base while enhancing customer experience is essential for strengthening client loyalty and driving cross-selling opportunities.

1. Clients that used a Poste Italiane digital channel;

2. Customers who have at least one on digital channel and one access in UP during the year;

3. CX refers to Customer Experience and is calculated as the average between Net Promoter Score “NPS” (70%) and Customer Effort Score “CES” (30%);

4. App User Stickiness is calculated as daily active users/monthly active users on Poste Italiane’s Apps;

5. Defined as all transactions (e.g. bill payments, bank transfers, etc.) as well as sales (e.g. subscription of financial products), excluding LIS transactions and sales

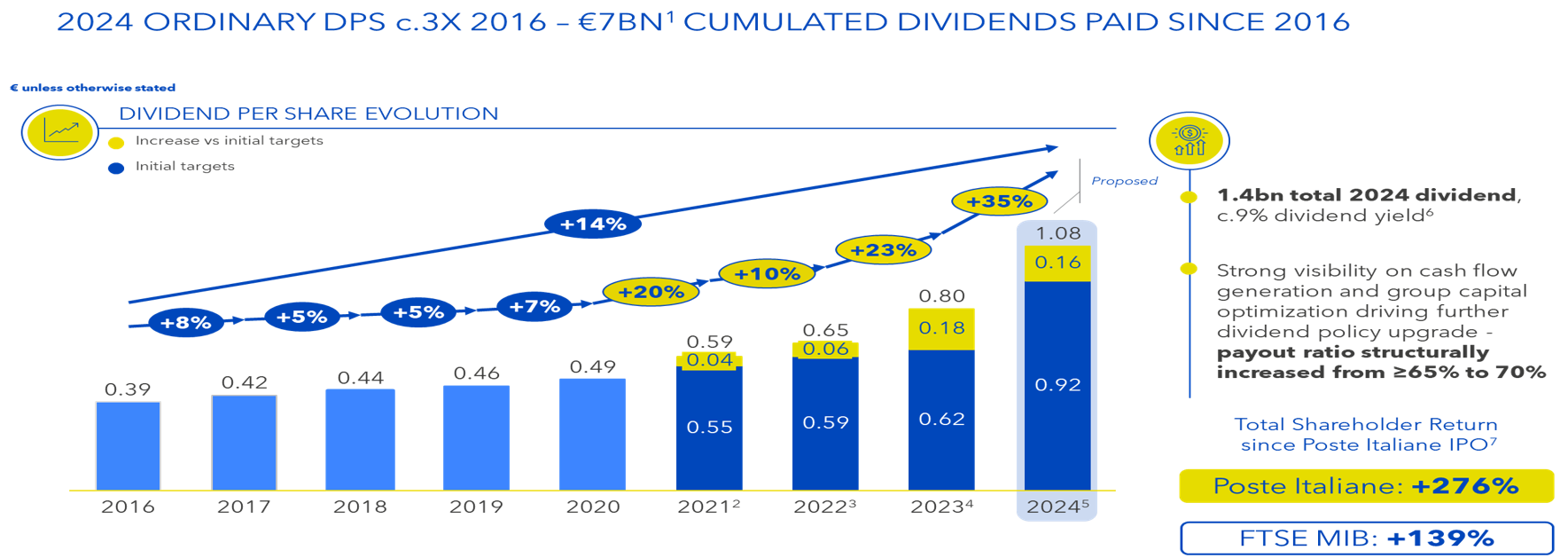

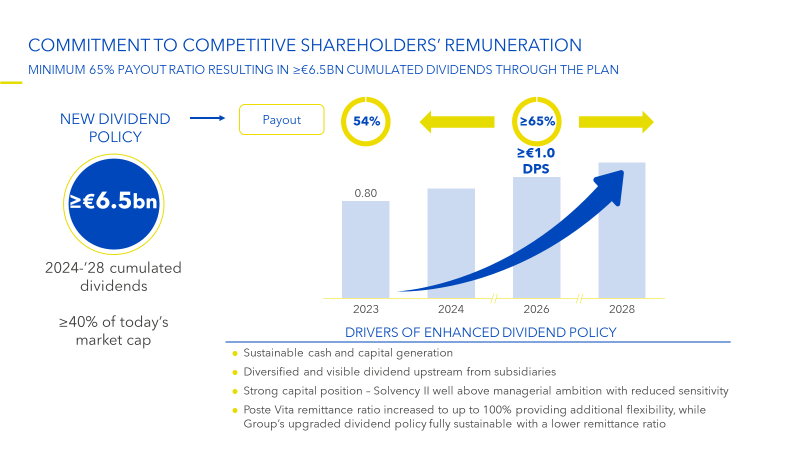

Dividend growth

With a record net profit of €2 billion and an increased payout ratio of 70%, 2024 dividends will amount to €1.4 billion, that’s €1.08 per share, reflecting an impressive 35% year-on-year growth and a 14% average annual growth since 2016.

2024 ORDINARY DPS c.3X 2016 – €7BN1 CUMULATED DIVIDENDS PAID SINCE 2016

UPGRADED 70% P/O RATIO DIVIDEND POLICY DRIVEN BY STRONG VISIBILITY ON CASH FLOW GENERATION AND CAPITAL OPTIMIZATION

1. Includes final installment of 2024 dividend to be paid, following AGM approval, in June 2025;

2. Initial target of 0.55 published for 24SI (Mar-21);

3. Initial target of 0.59 published for 24SI (Mar-21), first upgrade at 0.63 published for 24SI PLUS market cap of 2024; 7. Data from 27 October 2015 to 13 February 2025

4. Initial target of 0.62 published for 24SI (Mar-21), first upgrade at 0.68 published for 24SI PLUS (Mar-22), second upgrade at 0.71 published for CMD 2023 (Mar-23);

5. Initial target of 0.92 implied from Net Profit initial guidance of €1.9bn and 65% payout ratio;

6. Calculated on the average

7. Data from 27 October 2015 to 13 February 2025

Sustainable profitability and strong cash flow generation supporting enhanced dividend policy

Adjusted EBIT will grow by approximately 4% in line with the Business Plan, reaching €3.2 billion in 2028.

Thanks to strong visibility on future cash flows and group capital optimization, we are once again upgrading our dividend policy by structurally increasing the payout ratio from 65% to 70% throughout the 2028 plan.

KEY FINANCIAL TARGETS

Sustainable profitability and strong cash flow generation supporting enhanced dividend policy

| € bn unless otherwise stated | 2023 | 2024 | 2025 | 2026 | 2028 | CAGR 23 - 28 |

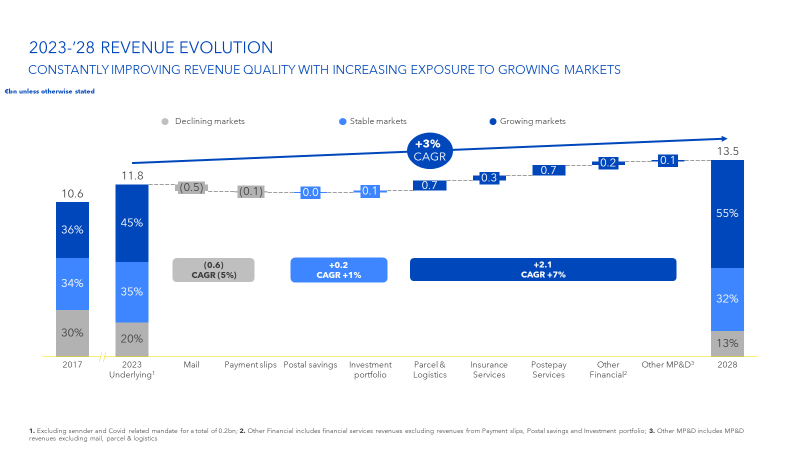

| REVENUE | 11.99 | 12.59 | 12.8 | 12.7 | 13.5 | +c.3% |

| EBIT | 2.62 | 2.96 | 3.2 | 2.9 | 3.2 | +c.4% |

| NET PROFIT | 1.93 | 2.0 | 2.2 | 2.0 | 2.3 | +c.4% |

|

DIVIDEND PER SHARE (€) |

0.80 | 1.08 |

|

≥1.0 | +c.7% | |

| DIVIDEND PAYOUT | 54% | increased from ≥65% to 70% | ||||

Generating sustainable growth

As a result, our business is now perfectly positioned to continue generating sustainable growth, with 80% of our revenues coming from growing and stable markets.

1. Other MP&D includes MP&D revenues excluding mail, parcel & logistics

New dividend policy

The new dividend policy results in a proposed 2024 DPS of € 1.08, marking an impressive 35% increase compared to last year and over-achieving our 2026 target two years ahead of schedule.

As a result, total dividends for 2024 amount to € 1.4 billion, reflecting an outstanding 9% dividend yield.

Once again, we are firmly committed to provide competitive remuneration for our shareholders.

1. 2024-2028 Strategic Plan “The Connecting Platform” presented in March 2024;

2. Dividend coverage ratio defined as total dividend from subsidiaries/business units divided by dividends to shareholders;

3. Calculated on the average market cap of 2024

Our approach to Sustainability

Our 2024–2028 Strategic Plan is grounded in ESG principles and and positions Poste Italiane as a key contributor to Italy’s sustainable growth and digital development. With a widespread presence across the country, Poste Italiane plays a vital role in supporting social cohesion, economic development, and the inclusion of underserved communities.

As Italy’s largest private employer, we invest in the continuous development of our people, promoting diversity, inclusion, equal opportunities and intergenerational dialogue, with a particular focus on younger generations.

We are implementing a structured decarbonisation strategy that targets our logistics network—one of the largest in Italy and our real estate assets, with a strong focus on emission reduction and energy efficiency. We also promote responsible resource use and circular economy models.

Our ongoing digital transformation enables us to offer secure and accessible services, both physical and digital, to citizens, businesses and public institutions. We actively engage our supply chain in achieving shared sustainability objectives.

Integrity and transparency are the foundation of our governance. Our commitment to sustainability is reflected in every aspect of the Group’s operations, including investment policies led by clear sustainable finance criteria.

We also work closely with our supply chain, promoting responsible business practices and aligning partners with our environmental, social and governance standards.

The ESG Presentation outlines how these principles are fully embedded in the Group’s industrial strategy, highlighting concrete initiatives, measurable results and a responsible governance framework aimed at long-term shared value creation for all stakeholders. This reflects Poste Italiane’s continued commitment to transparency, comparability and constructive engagement with the financial community, in line with evolving regulatory expectations and international best practices.