Innovation

Through a dynamic and future-oriented approach, Poste Italiane integrates state-of-the-art solutions to respond to new market challenges, promoting a work ecosystem in which people's growth and operational efficiency proceed in synergy.

Equity and merit

Equity and merit are key principles guiding all management and strategic initiatives, ensuring equal opportunities and leveraging the contribution of all individuals based on their abilities and commitment.

Trasparency and integrity

Transparency is an indispensable principle and a founding element of corporate governance, permeating every decision-making and management level. This value guides every interaction, both internal and external, ensuring a work environment based on mutual trust, clear processes and shared responsibility.

Health and safety

Poste Italiane guarantees a safe work environment that meets the highest international health and safety standards. The company has implemented specific measures to prevent accidents, reduce risks and promote the mental and physical well-being of its employees.

Inclusive well-being and welfare

Poste Italiane places people's well-being at the heart of its strategies, through an advanced and customised corporate welfare system designed to respond effectively to the needs of employees and their families. Corporate welfare policies and human capital management strategies feed off each other, in a virtuous process aimed at removing all cultural and social barriers and fostering the full professional realisation of each individual.

Collaboration, trust and proximity

In an increasingly dynamic and interconnected environment, collaboration is an essential lever to foster innovation and increase business value.

In addition to the above, on 28 June 2023, the Board of Directors, on the recommendation of the Remuneration Committee and in consultation with the Board of Statutory Auditors, awarded further remuneration to the Chairperson of the Board of Directors for the 2023-2025 term (pursuant to art. 2389, paragraph 3 of the Italian Civil Code). There are no forms of variable remuneration.

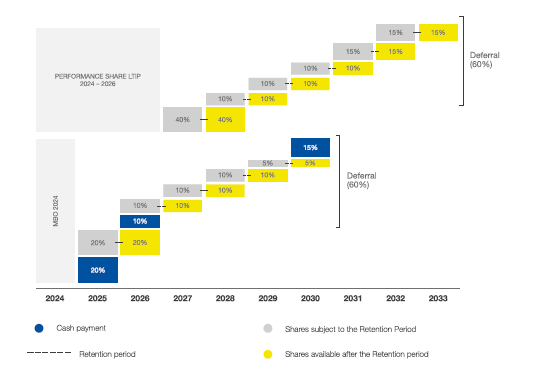

Please recall that the CEO is included in the perimeter of Material Risk Takers within the scope of application of the “Guidelines for BancoPosta RFC's remuneration and incentive policy for 2025” and the structure of the remuneration envisages a cap on total variable remuneration based on a 2:1 ratio between the variable (both short and long-term) and fixed component, in addition to deferral and retention periods.

Remuneration of the Chief Executive Officer includes a fixed component, a short-term variable component and a long-term variable component. In particular, with regard to variable incentive schemes, the accruable amount may thus be, at most, equal to approximately 71.71% of gross annual fixed compensation for the short-term system, and approximately 128.29% of gross annual fixed compensation for the long-term system, in continuity with recent years.

Finally, please recall that discretionary bonuses (one-off payments or special awards) cannot be assigned to the CEO.

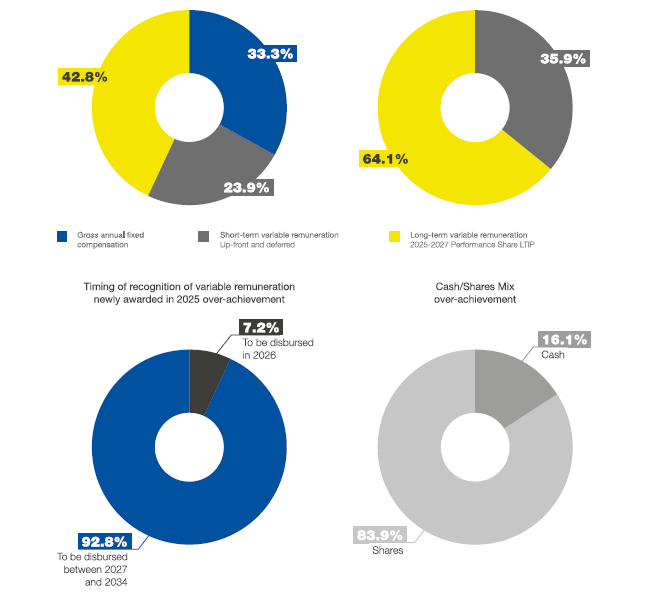

CEO PAY-MIX OF OVER-ACHIEVEMENT

Please note that the CEO is subject to share ownership guidelines for which the target level was raised in 2024 in order to further strengthen alignment with the long-term interests of investors. The structure of the payout over time involves the award of variable remuneration over a total period through to 2034, including performance, deferral and retention periods. Given the performance achieved, less than 10% of newly-assigned variable remuneration for 2025 will be effectively paid out in 2026, following approval of the financial statements for 2025 by the Shareholders’ Meeting, whilst the remaining portion is spread out over time. Each up-front and deferred component is subject to verification of BancoPosta RFC capital adequacy, liquidity and risk-adjusted profitability parameters.

In particular, the remuneration of other Directors consists of a fixed component, by way of compensation, determined by the Shareholders’ Meeting and applicable for the full term of office. As indicated above, the General Meeting of shareholders held on 8 May 2023, with regard to the term of office 2023-2025, determined the remuneration payable pursuant to art. 2389, paragraph 1 of the Italian Civil Code.

The Board of Directors, upon the proposal of the Remuneration Committee and having heard the opinion of the Board of Statutory Auditors, in its meeting of 28 June 2023, determined the additional compensation for the Directors who have been appointed as members of the Board Committees, according to the office assigned. These compensations are defined in continuity with the previous term of office.

The Annual General Meeting to be held on 30 May 2025 (pursuant to art. 2402 of the Italian Civil Code), when re-electing the Board of Statutory Auditors following termination of the term of office, will proceed to set the fees payable to the Chairperson and each standing Auditor for each year in office.

The fixed gross annual remuneration is € 870,000 gross per year.

No additional remuneration or allowances have been established for the office of General Manager.

The GM's remuneration is unchanged from last year.

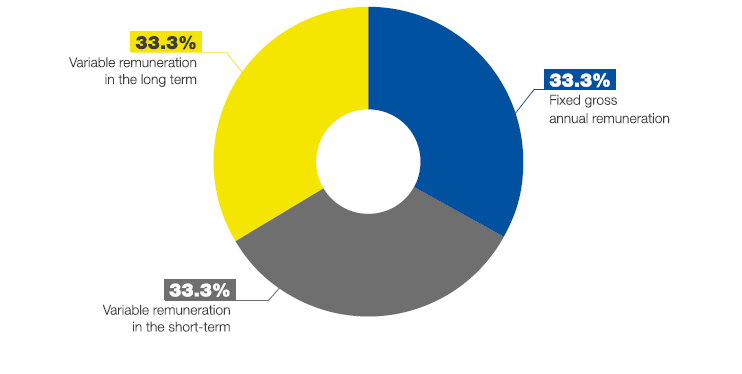

In light of these elements, the following chart shows the General Manager Pay Mix, assuming the achievement of results at target level.

This Pay Mix has been calculated on the basis of awards under the short and long-term incentive schemes at target, considering the entire value of the “2025-2027 Performance Share LTIP”.

Finally, please recall that discretionary bonuses (one-off payments or special awards) cannot be assigned to the GM.

ILLUSTRATION OF GM PAY-MIX AT TARGET

The “MBO” scheme for the General Manager envisages a hurdle condition represented by the “Poste Italiane Group’s adjusted EBIT”, set at the level of the budget, achievement of which enables the GM to access the bonus linked to achievement of the objectives assigned. The 2025 performance targets, are aligned with those of the CEO with the sole exception of the BancoPosta RORAC, are set out in line with the guidelines of the Strategic Plan, in accordance with the applicable areas of responsibility and are illustrated in the figure. Payment is entirely in monetary form with the payment of 70% of the bonus accrued at the end of the performance period and the remaining 30% deferred for one year, in order to guarantee a focus on the medium-term as well.

The 2025-2027 long-term incentive plan, entirely based on Poste Italiane shares, envisages the hurdle condition of the Poste Italiane Group's three-year cumulative adjusted EBIT, the achievement of which qualifies for the incentive. The performance targets for the GM are the same as those assigned to the CEO. The system involves up-front delivery for 40% of the rights and a two-year retention period for the remaining 60%.

The gross annual fixed pay for KMP is aligned with the role held, the scope of the responsibilities assigned, the experience and skills required for each position, the degree of excellence demonstrated and the overall quality of the individual’s contribution to the Company’s performance, also taking into account specific market benchmarks. Please recall that for KMP subject to specific supervisory regulations on remuneration, remuneration policies apply that are in line with the related statutory requirements and the provisions of the Group's Corporate Governance processes.

It is confirmed that, in continuity with 2024, also for KMP not subject to specific supervisory regulations on remuneration, in order to ensure a focus on the medium term as well, the MBO system is structured on the basis of the payment in monetary form of 70% of the bonus accrued at the end of the performance period and the remaining 30% deferred for one year. For KMP subject to specific supervisory regulations on remuneration, bonus payments are deferred over 3-5 years partly in monetary form and partly in financial instruments.

The “2025-2027 Performance Share LTIP” for KMP involves the granting of rights to receive Poste Italiane’s ordinary Shares at the end of a three-year performance period. The maximum number of shares reflects the complexity and responsibilities involved in the beneficiary’s role and their strategic importance. Furthermore, the KMP receive the Share Ownership Guidelines.

The LTIP and MBO plans have characteristics consistent with those of the CEO and the GM aligned with the scope of responsibility and structured consistent with the guidelines of the Strategic Plan.

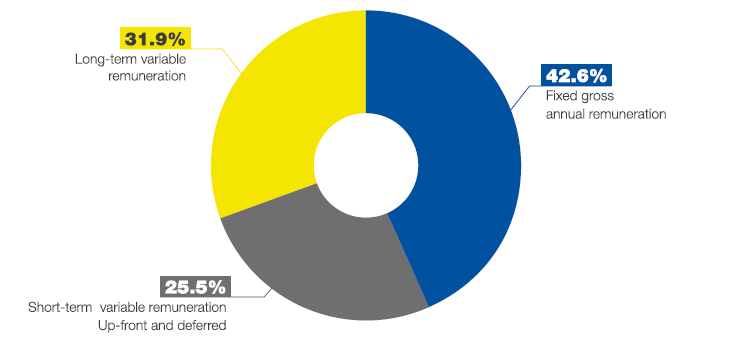

ILLUSTRATION OF MEDIAN KMP PAY MIX AT TARGET

Tables – CONSOB Form 7-bis*

TABLE 1: REMUNERATION PAID TO MEMBERS OF THE BOARD OF DIRECTORS AND BOARD OF STATUTORY AUDITORS, GENERAL MANAGERS AND OTHER KEY MANAGEMENT PERSONNEL

|

Name and surname or |

Position |

Period |

Expiry |

Fixed |

Fee for |

Variable non-equity payments |

Benefits |

Other |

Total |

Fair Value |

Severance indemnity at end of |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Bonuses

|

Profit sharing |

|||||||||||

| (A) | (B) | (C) | (D) | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| Silvia Maria Rovere | Chair |

01/01/2024 - 31/12/2024 |

appr. 2025 financial statements | |||||||||

| (I) Remuneration from company preparing financial statements | €480,000 | €25,0001 | €9,364 | €514,364 | ||||||||

| (II) Remuneration from subsidiaries and associates | ||||||||||||

| (llI) Total | €480,000 | €25,000 | €9,364 | €514,364 | ||||||||

| Notes: 1 For the position of Chair of the Sustainability Committee. | ||||||||||||

| Matteo Del Fante |

Chief Executive Officer1 |

01/01/2024 - 31/12/2024 |

appr. 2025 financial statements | |||||||||

| (I) Remuneration from company preparing financial statements | €1,432,3082 | €458,521 |

€14,743 |

€1,905,572 |

€1,321,383 |

|||||||

| (II) Remuneration from subsidiaries and associates |

||||||||||||

| (llI) Total | €1,432,308 | €458,521 | €14,743 | €1,905,572 | €1,321,383 | |||||||

| Notes: 1 Also General Manager from 01/01/2024 to 28/02/2024. 2 Of which €1,230,000 as Chief Executive Officer (consisting of €40,000 in remuneration determined by the General Meeting of shareholders in accordance with art. 2389, paragraph 1 of the Italian Civil Code and €1,190,000 in remuneration in accordance with art. 2389, paragraph 3 of the Italian Civil Code) and €202,308 as General Manager and Manager of the Company. |

||||||||||||

| Carlo D'Asaro Biondo | Director |

01/01/2024 - 31/12/2024 |

appr. 2025 financial statements | |||||||||

| (I) Remuneration from company preparing financial statements | €40,000 | €50,0001 | €90,000 | |||||||||

| (II) Remuneration from subsidiaries and associates |

||||||||||||

| (llI) Total | €40,000 | €50,000 | €90,000 | |||||||||

| Notes: 1 Of which €25,000 for the office of Chair of the Sustainability Committee and €25,000 for membership in the Control and Risk Committee. | ||||||||||||

| Valentina Gemignani | Director |

01/01/2024 - 31/12/2024 |

appr. 2025 financial statements | |||||||||

| (I) Remuneration from company preparing financial statements | €40,000 | €42,5001 | €82,5002 | |||||||||

| (II) Remuneration from subsidiaries and associates |

||||||||||||

| (llI) Total | €40,000 | €42,500 | €82,500 | |||||||||

| Notes: 1 Of which €25,000 for membership in the Control and Risk Committee and €17,500 for membership in the Nominations and Corporate Governarce Committee. 2 Amounts paid. |

||||||||||||

| Paolo Marchioni | Director |

01/01/2024 - 31/12/2024

|

appr. 2025 financial statements | |||||||||

| (I) Remuneration from company preparing financial statements | €40,000 | €45,4171 | €85,417 | |||||||||

| (II) Remuneration from subsidiaries and associates |

€806 | €806 | ||||||||||

| (llI) Total | €40,806 | €45,417 | €86,223 | |||||||||

| Notes: 1 Of which €17,500 for membership of the Remuneration Committee, €17,500 for membership of the Sustainability Committee and €10,417 for the office of Chair of the Related and Connected Parties Committee (the latter office from 01/08/2024 to 31/12/2024). | ||||||||||||

| Matteo Petrella | Director | 01/01/2024 - 31/12/2024 |

appr. 2025 financial statements | |||||||||

| (I) Remuneration from company preparing financial statements | €40,000 | €52,5001 | €92,500 | |||||||||

| (II) Remuneration from subsidiaries and associates |

€10,000 | €10,000 | ||||||||||

| (llI) Total | €50,000 | €52,500 | €102,500 | |||||||||

| Notes: 1 Of which €35,000 for the office of Chair of the Control and Risk Committee and €17,500 for membership in the Related and Connected Parties Committee. | ||||||||||||

| Armando Ponzini | Director | 01/01/2024 - 31/07/2024 |

appr. 2025 financial statements | |||||||||

| (I) Remuneration from company preparing financial statements | €23,333 | €24,7921 | €391 | €48,516 | ||||||||

| (II) Remuneration from subsidiaries and associates |

||||||||||||

| (llI) Total | €23,333 | €24,792 | €391 | €48,516 | ||||||||

| Notes: 1 Of which €14,584 for the office of Chairperson of the Related and Connected Parties Committee and €10,208 for membership in the Remunaration Committee. | ||||||||||||

| Patrizia Rutigliano | Director | 01/01/2024 - 31/12/2024 |

appr. 2025 financial statements | |||||||||

| (I) Remuneration from company preparing financial statements | €40,000 | €42,5001 | €521 | €83,021 | ||||||||

| (II) Remuneration from subsidiaries and associates |

||||||||||||

| (llI) Total | €40,000 | €42,500 | €521 | €83,021 | ||||||||

| Notes: 1 Of which €25,000 for the office of Chair of the Nominations and Corporate Governance Committee and €17,500 for membership in the Sustainability Committee. | ||||||||||||

| Vanda Ternau | Director | 01/01/2024 - 31/12/2024 |

appr. 2025 financial statements | |||||||||

| (I) Remuneration from company preparing financial statements | €40,000 | €35,0001 | €521 | €75,521 | ||||||||

| (II) Remuneration from subsidiaries and associates |

€15,000 | €15,000 | ||||||||||

| (llI) Total | €55,000 | €35,000 | €521 | €90,521 | ||||||||

| Notes: 1 Of which €17,500 for membership in the Nominations and Corporate Governace Committee and €17,500 for membership in the Related and Connected Parties Committee. | ||||||||||||

General Manager

|

Name and surname or |

Position |

Period |

Expiry |

Fixed |

Fee for |

Variable non-equity payments |

Benefits |

Other |

Total |

Fair Value |

Severance indemnity at end of |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Bonuses

|

Profit sharing |

|||||||||||

| (A) | (B) | (C) | (D) | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| Giuseppe Lasco | General Manager1 |

28/02/2024 - 31/12/2024 |

||||||||||

| (I) Remuneration from company preparing financial statements | €732,131 | €1,010,3411 | €20,232 | €1,762,704 | €438,003 | |||||||

| (II) Remuneration from subsidiaries and associates |

||||||||||||

| (llI) Total | €732,131 | €1,010,341 | €20,232 | €1,762,704 | €438,003 | |||||||

| Notes: 1 Co-General Manager and Head of Corporate Affairs from 01/01/2024 to 28/02/2024. | ||||||||||||

Board of Statutory auditors

|

Name and surname or |

Position |

Period |

Expiry |

Fixed |

Fee for |

Variable non-equity payments |

Benefits |

Other |

Total |

Fair Value |

Severance indemnity at end of |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Bonuses

|

Profit sharing |

|||||||||||

| (A) | (B) | (C) | (D) | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| Mauro Lonardo | Chairperson of the Board of Statutory Auditors |

01/01/2024 - 31/12/2024 |

appr. 2024 financial statements |

|||||||||

| (I) Remuneration from company preparing financial statements | €80,000 | €80,000 | ||||||||||

| (II) Remuneration from subsidiaries and associates |

€100,363 | €100,363 | ||||||||||

| (llI) Total | €180,363 | €180,363 | ||||||||||

| Gianluigi Fiorendi | Standing Auditor |

01/01/2024 - 31/12/2024 |

appr. 2024 financial statements |

|||||||||

| (I) Remuneration from company preparing financial statements | €70,000 | €70,000 | ||||||||||

| (II) Remuneration from subsidiaries and associates |

€8,253 | €8,253 | ||||||||||

| (llI) Total | €78,253 | €78,253 | ||||||||||

| Serena Gratteschi | Standing Auditor |

01/01/2024 - 31/12/2024 |

appr. 2024 financial statements |

|||||||||

| (I) Remuneration from company preparing financial statements | €70,000 | €70,000 | ||||||||||

| (II) Remuneration from subsidiaries and associates |

€36,505 | €36,505 | ||||||||||

| (llI) Total | €106,505 | €106,505 | ||||||||||

Key Management Personnel

|

Name and surname or |

Position |

Period |

Expiry |

Fixed |

Fee for |

Variable non-equity payments |

Benefits |

Other |

Total |

Fair Value |

Severance indemnity at end of |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Bonuses

|

Profit sharing |

|||||||||||

| (A) | (B) | (C) | (D) | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| Key Management Personel (16 resources1) |

|

|||||||||||

| (I) Remuneration from company preparing financial statements | €6,213,363 | €6,091,493 | €241,684 | €12,546,540 | €2,804,688 | |||||||

| (II) Remuneration from subsidiaries and associates |

||||||||||||

| (llI) Total | €6,213,363 | €6,091,493 | €241,684 | €12,546,540 | €2,804,688 | |||||||

| Notes: 1 There is no requirement, under existing regulations, for disclosure on an individual basis, given that in 2024, none of the Key Management Personell received higher total compensation than the CEO including (also with reference to the tables below) the pro rata temporis values for Giuseppe Lasco as Co-General Manager and Head of Corporate Affairs from 01/01/2024 to 28/02/2024. 2 Remuneration payable for the role of Director and for specific positions held in Group companies, approved in accordance with art. 2389 of the Italian Civil Code, amounting to a total of €988,175, is paid entirely to Poste Italiane S.p.A. 3 Remuneration payable for the role of Director and for specific positions held in Group companies, approved in accordance with art. 2389 of the Italian Civil Code, amounting to a total of €553,966, is paid entirely to Poste Italiane S.p.A. |

||||||||||||

* The amounts included in the tables are computed on an accruals basis, where necessary. The variable pay shown in the tables is based on an estimate of the amount payable at the time of preparing this document, whilst awaiting approval of the Company’s financial statements by the Shareholders’ Meeting

Last update: May 30, 2025

- Remuneration Highlights 2025

- Report on the 2025 remuneration policy and on the amounts paid in 2024

- Equity-based incentive plans

- Remuneration Highlights 2024

- Report on the 2024 remuneration policy and on the amounts paid in 2023

- Equity-based incentive plans

- Remuneration Highlights 2023

- Report on the 2023 remuneration policy and on the amounts paid in 2022

- Equity-based incentive plans

- Remuneration Highlights 2022

- Report on the 2022 remuneration policy and on the amounts paid in 2021

- Equity-based incentive plans

- Remuneration Highlights 2021

- Report on the 2021 remuneration policy and on the amounts paid in 2020

- Equity-based incentive plans

- Remuneration Highlights 2020

- Report on the 2020 remuneration policy and on the amounts paid in 2019

- Information document on Equity-based incentive plan

- Remuneration report 2019

- Information circular 2019 on Equity-based incentive plans

- Remuneration report 2018

- Incentive plan, based upon financial instruments, addressed to the material Risk Takers of BancoPosta’s Ring-Fenced Capital

- Remuneration report 2017

- Remuneration report 2016

- Information document related to the LTI plan 2016-2018

- Information Circular related to the STI plan 2017 for BancoPosta’s MRT