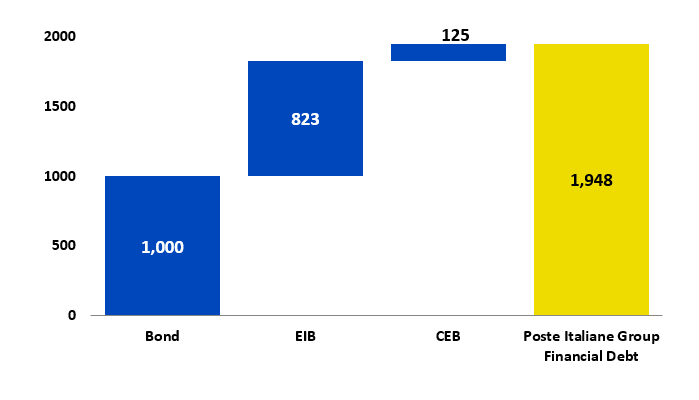

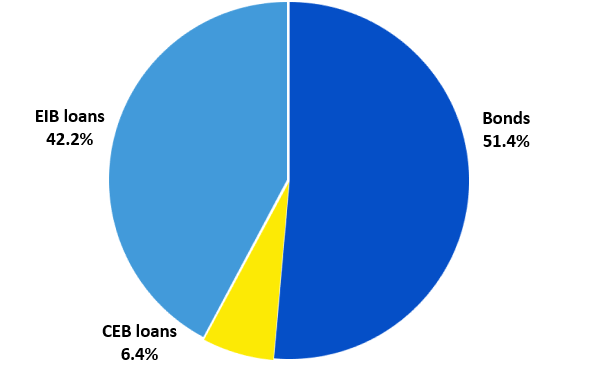

As of 31 December 2024, financial debt of the Group towards third parties amounts to €2,013 million (nominal value), entirely issued by Poste Italiane S.p.A., consisting of:

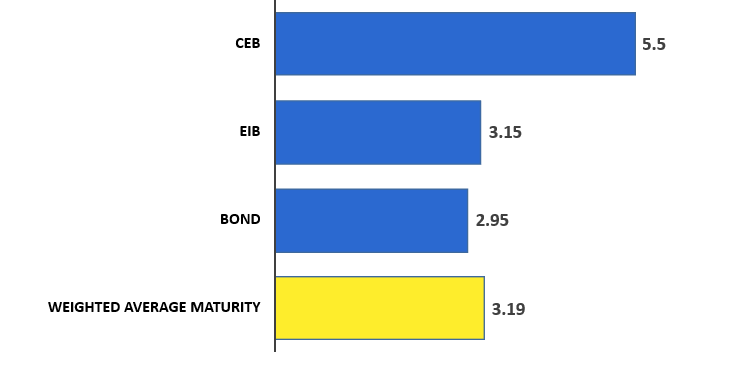

- a senior unsecured bond with a nominal value of €500 million, issued on 10 December 2020 and maturing on 10 December 2028. The bond was issued below par at 99.758, carries a fixed annual coupon of 0.50%, and has an effective yield to maturity of 0.531%. The bond is part of a two-tranche issuance placed in public form to institutional investors for a total amount of €1 billion, the first tranche of which was redeemed on 10 December 2024;

- five loans for specific investment projects granted by the EIB – European Investment Bank – totaling €1,273 million (€573 million maturing in 2026, €250 million maturing in 2028 and €450 million maturing in 2031).

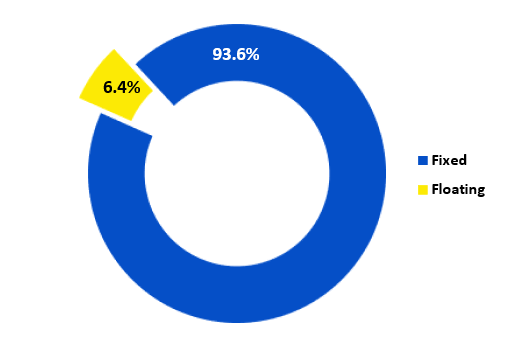

- two loans totaling €240 million granted by the CEB – Council of Europe Development Bank – under a medium to long-term credit line of €250 million aimed at supporting projects and investments focused on social integration, infrastructure development, and sustainability. The two loans, disbursed at floating interest rates on 28 December 2023 and 25 January 2024, respectively mature in 2030 (€125 million) and 2031 (€115 million) with an amortizing repayment schedule following a three-year grace period.

On the same date, the Strategic Business Unit Mail, Parcels and Distribution has Liquidity in bank and postal current accounts of €617 million. Such amount represents the Group's free liquidity generated by the company's self-financing capability, partly attributable to Poste Italiane S.p.A. and partly deriving from the centralization of the Group liquidity and from the related cash pooling activity by the parent company.

Furthermore, as of 31 December 2024 Poste Italiane S.p.A. has about €3.7 billion of undrawn committed and uncommitted credit lines of which Revolving Credit Facilities committed of €2.75 billion.

Financial debt does not include a perpetual subordinated 8-year non-call hybrid securities issue, with a nominal value of €800 million, issued on June 24, 2021 and placed in public form to institutional investors, as such hybrid bond is accounted for in equity. The securities, which have no fixed maturity, become due and payable only in the event of winding-up or liquidation of the Company, as specified in the terms and conditions, save for optional redemption (call), where applicable. The "First Call Date" is March 24, 2029. The annual fixed coupon is 2.625% until the first Reset Date of 24 June 2029. As from such date, interest per annum is determined according to the relevant 5-year Euro Mid Swap rate, plus an initial spread of 267.7 basis points, increased by an additional 25 basis points as from 24 June 2034 and a subsequent increase of additional 75 basis points as from 24 June 2049. The fixed coupon is payable annually in arrears, starting from 24 June 2022. The issue price has been set at 100% and the effective yield to the first "Reset Date" is equal to 2.625% per annum.

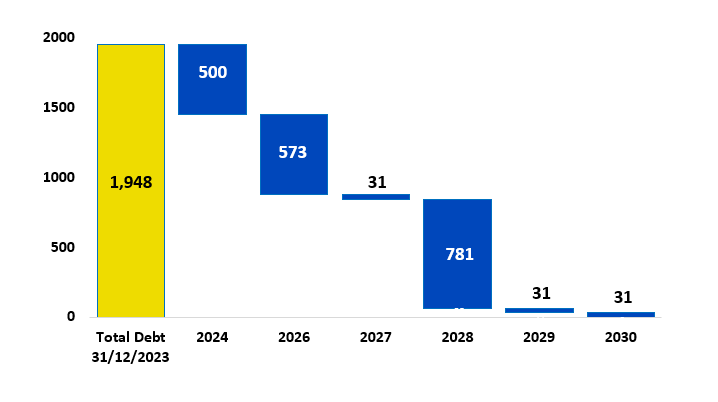

Notes: all amounts are expressed at nominal value and exclude leases deriving from the application of IFRS 16, funding from current account deposits of BancoPosta, repurchase agreements, derivative financial instruments and other financial liabilities mainly referring to BancoPosta RFC. Financial debt does not include the Perp NC8 2.625% hybrid bond of €800 million issued on June 24, 2021, as it is accounted for in equity.

FIX/FLOAT

Notes: all amounts are expressed at nominal value and exclude leases deriving from the application of IFRS 16, funding from current account deposits of BancoPosta, repurchase agreements, derivative financial instruments and other financial liabilities mainly referring to BancoPosta RFC. Financial debt does not include the Perp NC8 2.625% hybrid bond of €800 million issued on June 24, 2021, as it is accounted for in equity.

| Issuer | Poste Italiane S.p.A. | Poste Italiane S.p.A. |

|---|---|---|

| ISIN | XS2270397016 | XS2353073161 |

| Seniority | Senior | Subordinated |

| Currency | EUR | EUR |

| Amount | 500,000,000 | 800,000,000 |

| Issue Date | 10/12/2020 | 24/06/2021 |

| Expiry Date | 10/12/2028 | Perp NC8 |

| Issue Price | 99.758% | 100.00% |

| Coupon | 0.50% | 2.625% until 24/06/2029 |

| Frequency | Annually | Annually |

| Type of Issue | Public Issue | Public Issue |

| Accounting | Debt | Equity |

| First Call Date | 24/03/2029 |

| €/m (Nominal Value) | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|---|

| Use of uncommitted credit lines | - | - | 250 | 550 | - | - | - |

| Medium and long-term loans | - | - | 250 | - | - | - | - |

| Private Placement | 50 | 50 | 50 | 50 | 50 | - | - |

| EIB loans | 200 | 573 | 573 | 723 | 823 | 823 | 1,273 |

| CEB loans | - | - | - | - | - | 125 | 240 |

| Poste Italiane Bond | - | - | 1,000 | 1,000 | 1,000 | 1,000 | 500 |

| Poste Vita Bond | 750 | - | - | - | - | - | - |

| GROSS FINANCIAL DEBT TOWARDS THIRD PARTIES | 1,000 | 623 | 2,123 | 2,323 | 1,873 | 1,948 | 2,013 |

| EQUITY | 8,105 | 9,698 | 11,507 | 12,110 | 8,937 | 10,439 | 11,709 |

| EBITDA | 2,068 | 2,548 | 2,224 | 2,636 | 3,121 | 3,431 | 3,401 |

| DEBT/EQUITY | 0.1 | 0.1 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 |

| DEBT/(DEBT + EQUITY) | 11% | 6% | 16% | 16% | 17% | 16% | 15% |

| DEBT/EBITDA | 0.5x | 0.2x | 1.0x | 0.9x | 0.6x | 0.6x | 0.6x |

| Mail, Parcels and Distribution's cash and cash equivalents | 973 | 851 | 2,254 | 2,121 | 575 | 650 | 617 |

Notes

1) The Hybrid Bond PERP NC8 2,625% €800 million issued on June 24, 2021, is included in the Equity amount. All amounts are expressed at nominal value and exclude leases deriving from the application of IFRS 16, funding from current account deposits of BancoPosta, repurchase agreements, derivative financial instruments and other financial liabilities mainly referring to BancoPosta Ring-Fenced Capital.

2) FY2021 and FY 2022 don't include IFRS17 adjustments.

On 24 June 2021, Poste Italiane S.p.A. issued a perpetual subordinated hybrid bond with an 8-year non-call period and a nominal value of €800 million. The bond was publicly placed with institutional investors and classified as equity under applicable accounting standards.

- Final Terms Bond 03.12.2030 XS3244877869

- Base Prospectus EMTN First Supplement 24.11.2025

- Base Prospectus EMTN 27.06.2025

- Agency Agreement - Schedule 5 - EMTN 27.06.2025

- Base Prospectus EMTN 06.12.2023

- Agency Agreement - Schedule 5 - EMTN 06.12.2023

- Base Prospectus EMTN 16.12.2022

- Final Terms Bond 10.12.2028 XS2270397016

- Final Terms Bond 10.12.2024 XS2270395408

- Prospectus Hybrid Bond PerpNC8 21.06.2021

- Company Presentation 04.06.2021

- Poste Italiane resolutions of the Shareholders’ Meeting 2021

- Interim Report for the three months ended 31 march 2021

- Base Prospectus Second Supplement 18.05.2021

- Poste Italiane the Board of Directors approves Nexive re-organization plan within the framework of the Group

- Poste Italiane Q1 2021 Financial Results

- Annual Financial Report 2020

- Poste Italiane completes the acquisition of Nexive Group

- Poste Italiane to acquire 51% of Sengi Express, a company specialised in cross-border logistics services for the Chinese e-commerce market

- Poste Italiane to acquire a 40% stake in BNL Finance, a company specialised in salary backed loans

- Poste Italiane €1 billion bond issuance, investor demand exceeding the offer by over 5 times

- Base Prospectus Supplement 30.11.2020

- Company Presentation 30.11.2020

- Poste Italiane signs a preliminary agreement for the possible acquisition of Nexive

- Interim Report for the nine months ended 30 September 2020

- Base Prospectus EMTN 06.11.2020

- Half-year report for the six months ended 30 June 2020

- Annual Report 2019 EMTN

- Annual Report 2018 EMTN

Rating

|

|

|

|

|

|---|---|---|---|

| Poste Italiane S.p.A. | BBB+ | Pos | A-2 |

Last Rating Action: 3/02/2026

|

|

|

|

|

|---|---|---|---|

| Poste Italiane S.p.A. | Baa2 | Stab | P-2 |

Last Rating Action: 24/11/2025

|

|

|

|

|

|---|---|---|---|

| Poste Italiane S.p.A. | BBB+ | Pos | S-2 |

Last Rating Action: 12/11/2025

(*) Ratings solicited

Last Rating Actions and Poste Italiane Analysis

| Agency | Long term | Short term | Outlook | Rating action / Affirmation | Credit Opinion Report |

|---|---|---|---|---|---|

| Standard & Poor's | BBB+ | A-2 | Positive | 3/02/2026 | 28/07/2025 |

| Moody's | Baa2 | P-2 | Stable | 24/11/2025 | 29/05/2025 |

| Scope Ratings | BBB+ | S-2 | Positive | 12/11/2025 | 12/11/2025 |

Rating Corporate Hybrid PerpNC8 2,625%

|

|

|

|

|---|---|---|

| Standard & Poor's | BBB- | 28/07/2025 |

| Moody's | Ba1 | 24/11/2025 |

| Scope Ratings | BBB- | 12/11/2025 |