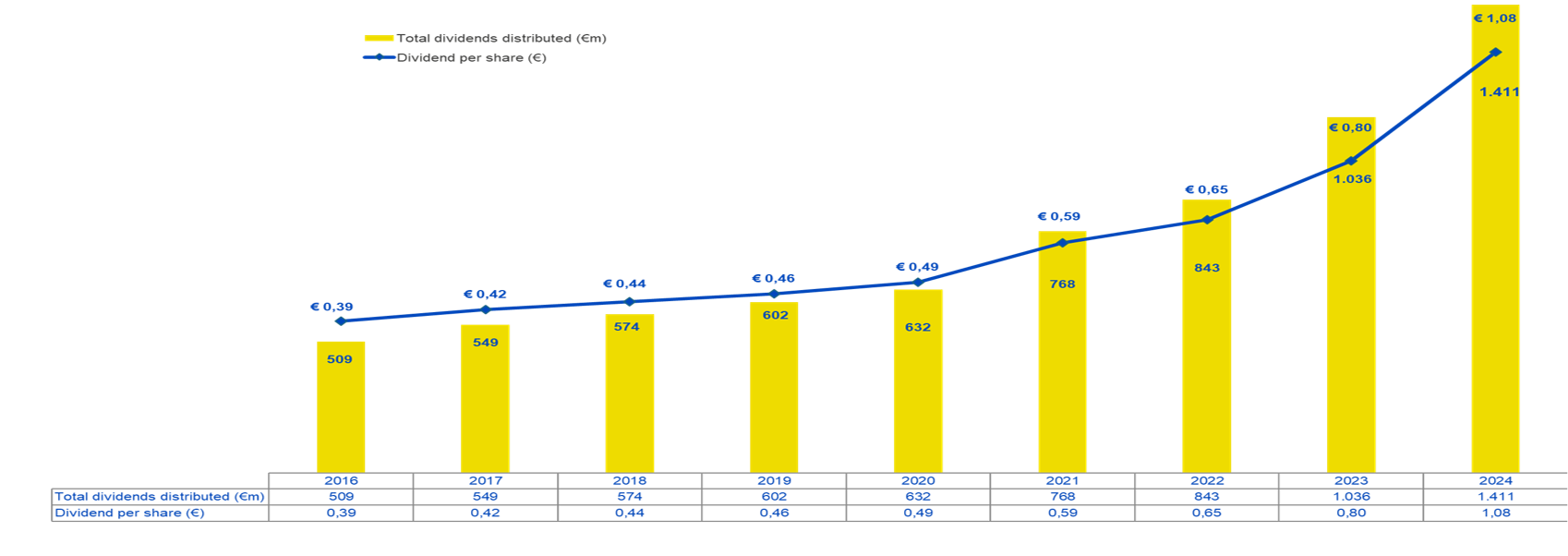

Group dividend policy

Our objective is to guarantee a competitive return to shareholders. For the 2024 results, we have proposed a dividend of €1.08 per share — a 35% increase year-on-year and nearly triple the amount paid in 2017 (€ 0.42).

Thanks to strong visibility on future cash flows and group capital optimization, we are yet again upgrading our dividend policy by structurally increasing the payout ratio from 65% to 70% throughout the 2028 plan. As a result, our new target of cumulated dividends for the 5-year plan increases from € 6.5 billion to around € 7.5 billion.

Thanks to strong visibility on future cash flows and group capital optimization, we are yet again upgrading our dividend policy by structurally increasing the payout ratio from 65% to 70% throughout the 2028 plan. As a result, our new target of cumulated dividends for the 5-year plan increases from € 6.5 billion to around € 7.5 billion.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|---|---|---|

| Total dividends distributed (€m) | 509 | 549 | 574 | 602 | 632 | 768 | 843 | 1,036 | 1,411 |

| Dividend per share (€) | 0.39 | 0.42 | 0.44 | 0.46 | 0.49 | 0.59 | 0.65 | 0.80 | 1.08 |