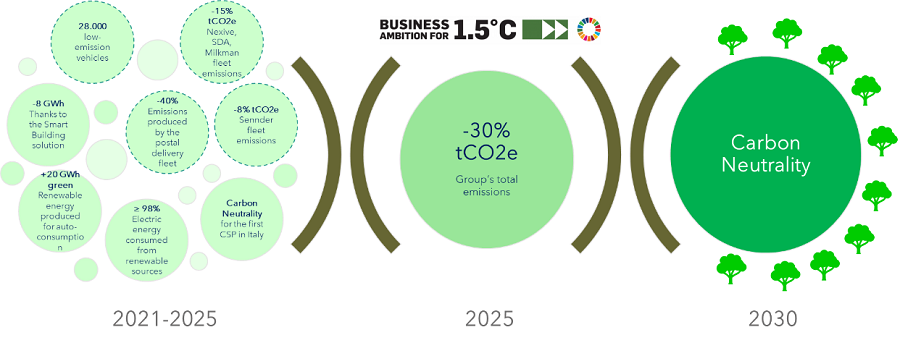

The transition towards carbon neutrality: Poste Italiane’s strategy

|

|

|

|

|

|---|

On a final note, Poste Italiane Group demonstrates a real commitment to aligning with European and international climate goals by including this approach in the management of engagement initiatives with policymakers and trade organizations. For more information, refer to the in-depth document .

Governance on Sustainability

Environmental performance 2023

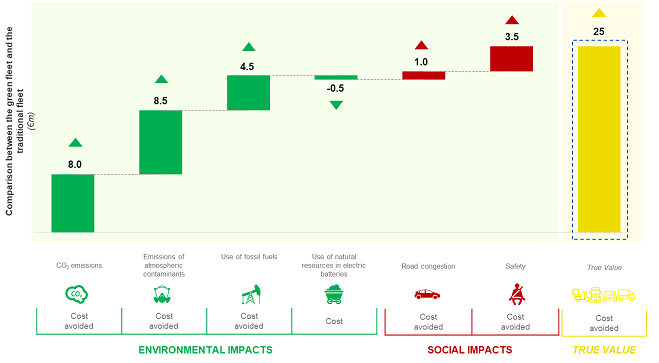

The Fleet Renewal Plan, initially launched in 2019 with the aim of replacing the entire fleet of vehicles intended for the delivery of postal products with green vehicles, continued in 2023 through a series of measures aimed at reducing energy consumption, atmospheric emissions, improving safety and increasing carrying capacity for delivery. In parallel with the increase in safety levels through the replacement of two-wheeled vehicles with three- and four-wheeled vehicles, electrically powered vehicles have been strengthened in order to promote "ecological mobility". To improve the organisation of delivery loads, Poste Italiane has introduced larger and more functional vehicles for parcel transport and delivery needs, implementing new equipment.

The new vehicles will guarantee:

- a reduction in energy consumption;

- lower emissions into the atmosphere;

- greater safety;

- greater load capacity for delivery.

Green Postal Day 2023

The initiative promoted by the postal sector emphasises the importance of collaboration with a view to exchanging best practices and stimulating individual companies to go beyond their initial targets. The use of a common measurement system has also fostered transparency and guided sustainability choices.

POSTE ITALIANE IN THE FIELD TO BUILD GREEN INVESTMENT PLANS

The portfolios of BancoPosta Fondi SGR and Poste Vita are periodically subjected to ESG analysis to assess their degree of social responsibility, and carbon footprint, with the aim of mitigating any risks. The results obtained both for BancoPosta Fondi SGR and Poste Vita, also this year are higher than the ESG performance of reference benchmarks.Climate Action 100+

In line with its decarbonisation strategy and in implementation of the guidelines for the exercise of voting rights and engagement activities and for investment in sensitive sectors, Poste Italiane, through its subsidiaries Poste Vita and BancoPosta Fondi SGR, has joined Climate Action 100+, an international collaborative engagement initiative to raise awareness of climate change issues among the world's largest greenhouse gas emitters.Poste Italiane participates to “Earth Day”

Like in previous years, the Group participated in the customary celebration of Earth Day, the world's most important event for environmental protection, established by the UN in 1970. In 2023, the 53rd edition of the event focused on supporting events aimed at raising awareness of good practices with a view to environmental sustainability, with a spirit of collaboration between citizens and governments from all over the world. At the end of the day, a memorandum with 52 tips for reducing environmental impact was published.In addition, Poste Italiane took part, for the fifth consecutive year, in Green Postal Day, an event promoted by the International Post Corporation in cooperation with PostEurop. This initiative aims to highlight the environmental and commercial successes achieved by the postal industry through collaboration within the sector to reduce CO2 emissions. By participating in this event, the Company reinforces the validity of its corporate strategy, which aims to integrate sustainability into all areas of the Group's business, with the goal of becoming carbon neutral by 2030.- possession of environmental, quality and energy performance certifications;

- adoption of environmental management systems

- ethical standards of behavior;

- Minimum Environmental Criteria (CAM).

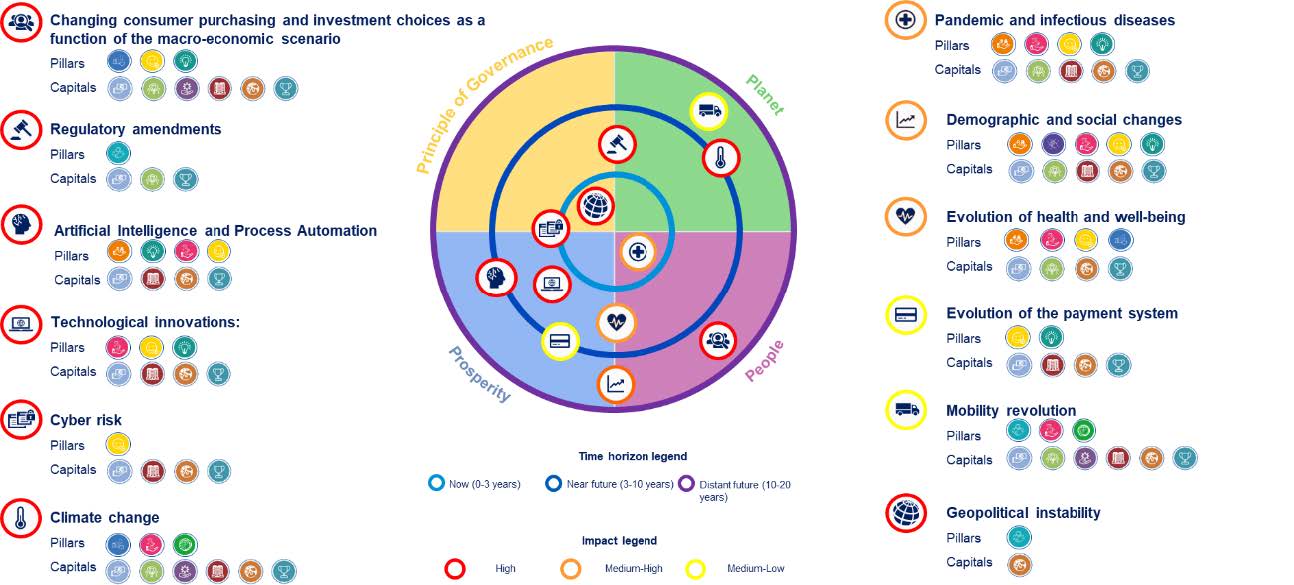

The correct identification and assessment of climate-related risks and opportunities is also ensured by listening to stakeholders. Stakeholders are periodically involved in the Multistakeholder Forums organized by Poste Italiane and have a reporting system that allows them to bring any perceived risks to the attention of the Company.

- uncertainty and visibility: lack of data to analyse the phenomenon and difficulty in finding skills, knowledge and awareness of the potential effects that emerging risks have on a business model;

- timing of changes: the changes derive from radical changes in the external reference context (socio-environmental, legislative, technological, habits, etc.) which alter the processes from various points of view, in a destructive and unpredictable way over time;

- management complexity: increasing complexity of management methods, related to the absence of immediate response actions to events resulting from highly interconnected exogenous factors with strong systemic dependencies and time accelerations.

- Ageing population

- Increased longevity combined with low birth rate resulting in a negative change in the generational distribution of customers for Poste Italiane

- The economic and employment insecurity of younger people

Aggravated by geopolitical instability, calls for more and more support and assistance policies that could generate increased demand for mortgages and investment loans - Increase in the rate of depopulation of the peninsula's more inland areas, in favour of more urbanised and developed cities

The increase in urban population may overload existing infrastructure, lead to environmental problems and cause socio-economic disparities between urban and rural areas

- Regulatory Amendments

- Increased severity in the reference legislation applicable to the business with particular reference to environmental variables

- Pandemic Risk

- Negative effects for Poste Italiane’s business from the global spread of new pandemics globally

- Technological innovations:

- Adverse consequences for people, businesses and ecosystems due to the development of innovative technological solutions (e.g. e-substitution, digital inequalities, digital market concentration, etc.)

- Cyber risk

- Risk of incurring economic/financial losses and/or reputational damage as a result of accidental events or malicious actions relating to the security of the information system (hardware, software, data banks, sensitive data, etc.), also in view of the constant increase in the use of information systems and technological advancements in the field of Artificial Intelligence

- Climate change

- Possible negative impacts of climate change phenomena on Poste Italiane’s business and on its reputation

- Evolution of the payment system

- Negative change in consumer purchasing behaviour for Poste Italiane in relation to the payment instruments to be used (e.g. cryptocurrencies, fintech, etc.) also due to the introduction of new payment methods.

- Mobility revolution

- Need to review business models and delivery operations due to the introduction of new mobility models,technological evolution of vehicles, sharing mobility.

- Evolution in consumer behaviour

- Changes in consumer urchasing habits as a function of the macro-economic scenario and customer needs and expectations, requiring the ability to grasp these changes in a short timeframe and respond through operational and production adaptations, even profound ones

- Geopolitical instability

- Possible negative impacts on Poste Italiane business due to geopolitical tensions and international conflicts.

- Artificial intelligence and process automation

The correct identification and assessment of climate-related risks and opportunities is also ensured by listening to stakeholders. They are periodically involved in the Multi-stakeholder Forums organised by Poste Italiane and have a reporting system that allows them to bring any perceived risks to the attention of the Company.

The portfolios of BancoPosta Fondi SGR and Poste Vita are periodically subjected to ESG analysis to assess their degree of social responsibility, and carbon footprint, with the aim of mitigating any risks. The results obtained both for BancoPosta Fondi SGR and Poste Vita, are higher than the ESG performance of reference benchmarks.

As part of the Poste Italiane Group's strategy for pursuing its Sustainability objectives, the integration of ESG principles into its investment processes is also of particular importance, with investments in sectors that contribute to the Sustainable Development Goals ("SDGs") (e.g. investments in bonds in the "Green", "Social" and "Sustainable" categories in line with the standards and principles defined by the International Capital Market Association).

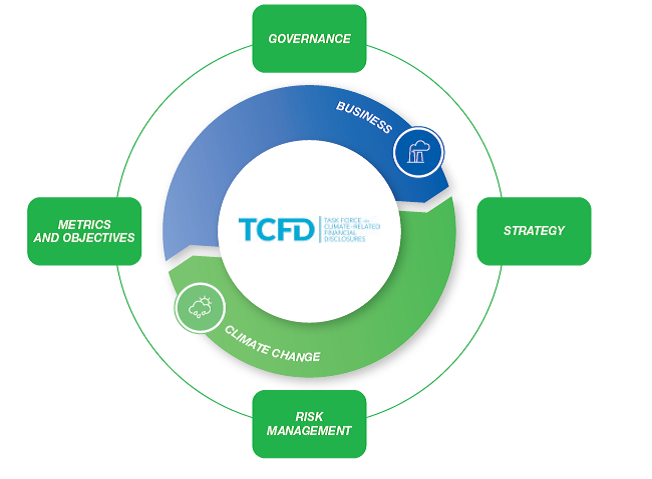

Poste Italiane, in accordance with the main regulatory trends and in response to the growing requests from the financial community and the main stakeholders, reports information regarding climate change on the basis of the areas defined by the TCFD: Governance, Strategy, Risk Management, Metrics and Objectives.

1. REGULATORY DEVELOPMENTS (1)

| RISK | RISK POTENTIAL SIGNIFICANT IMPACTS FOR POSTE ITALIANE | MAIN RISK MANAGEMENT ACTIONS AND TOOLS | |

|---|---|---|---|

| Increased severity in legislation in consideration of climate change related targets Time frame: Medium term Pillars impacted

Integrity and transparency Working with integrity and transparency |

Negative impacts:

|

As part of the Integrated Compliance process, Poste Italiane continuously monitors the external regulations relevant to the Group and translates the set of regulatory principles into the body of rules required to ensure their application. The inventory of all regulations relevant to the Group is managed in an integrated manner on the dedicated GRC platform. Poste Italiane also takes part in technical and working groups on regulatory developments, in order to ensure analysis of changes in the regulatory framework, guaranteeing its correct implementation, and represent the Company’s position on these issues to national and international bodies, in order to support the Group’s business. |

|

| Capitals impacted | Opportunities:

|

||

|

Human | ||

|

Intellectual | ||

|

Financial | ||

(1) In the area of risk related to regulatory developments, the Group identifies and assesses risks related to both current regulations and possible future developments.

2. MARKET DEVELOPMENTS

| RISK | POTENTIAL SIGNIFICANT IMPACTS FOR POSTE ITALIANE | MAIN RISK MANAGEMENT ACTIONS AND TOOLS | |

|---|---|---|---|

| Evolving market demand, focusing increasingly on environmental issues, which require substantial adjustments to the services and products offered by the Group Time frame: Long term Pillars impacted |

Negative impacts:

|

Poste Italiane Poste Italiane is actively engaged in developing existing products/services with alternatives that take ESG criteria into account (e.g., investments, insurance) in order to ensure an increasingly wide range of products and services that integrate high ethical standards and environmental criteria. The portfolios of Bancoposta Fondi SGR and Poste Vita are periodically subjected to ESG analysis to assess their degree of social responsibility, and carbon footprint, with the aim of mitigating any risks. An example can be seen in the development of insurance solutions that, on the one hand, encourage the adoption of sustainable and responsible behaviour by its policyholders and, on the other, contribute to mitigating ESG risks. The results obtained both for BancoPosta Fondi SGR and Poste Vita, are higher than the ESG performance of reference benchmarks. As part of the Poste Italiane Group’s strategy for pursuing its sustainability objectives, the integration of ESG principles into its investment processes is also of particular importance, with investments in sectors that contribute to the Sustainable Development Goals (“SDGs”) (e.g. investments in bonds in the “Green”, “Social” and “Sustainable” categories in line with the standards and principles defined by the International Capital Market Association). |

|

|

Sustainable Finance Integration of ESG factors into investment policies; Integration of ESG factors into insurance policies. |

Opportunities:

|

|

| Capitals impacted: | |||

|

Human | ||

|

Intellectual | ||

|

Financial | ||

|

Social-relational | ||

|

Natural | ||

3. TECHNOLOGICAL DEVELOPMENTS AND INNOVATION

| RISK | POTENTIAL SIGNIFICANT IMPACTS FOR POSTE ITALIANE |

MAIN RISK MANAGEMENT ACTIONS AND TOOLS | |

|---|---|---|---|

| Failure to adjust its business model in line with the technological developments needed to contain climate change related phenomena Time frame: Long term |

Negative impacts:

|

Poste Italiane's support in the transition to a low-carbon economy is driven by its commitment to set targets to reduce emissions and the environmental impact generated by its activities, achieving Carbon Neutrality targets by 2030. With this in mind, starting in 2019, the Group has implemented a Fleet Renewal Plan that envisages replacing the entire fleet of vehicles used for the delivery of postal products with green vehicles. The results of this policy are evident, as the Company has gone from 11% green vehicles in 2016 to 37% in 2022, more than doubling this percentage by 2021, with the aim of replacing the entire company fleet with low- emission vehicles by 2024, resulting in a CO2 reduction equal to that of around 80,000 trees. Among companies in the utility sector, Poste Italiane has one of the largest fleets of 100% electric commercial vehicles in the country. A pilot project has been implemented in certain cities, which involves the delivery of vehicles and packages using fully electric vehicles, namely with zero emissions. The zero-emissions delivery project has also been completed in 15 city centres. There are more than 8,000 ecological vehicles or low emission vehicles currently being used by Poste Italiane. The Group is also introducing the use of new threewheeled electric motorcycles in several cities, to make the delivery of parcels and correspondence by Poste Italiane environmentally friendly, easy and safe. The new tricycles are completely electric-powered, with a capacity of 4 kW that guarantees a maximum speed of 45 km/h in line with the limits imposed by the Highway Code in towns and cities, and energy self-sufficiency of about 60 km that enables postmen to complete their daily delivery round with a single charge. For each new vehicle, Poste Italiane will also install a new electric recharging station, confirming its desire to ensure environmental sustainability in territories and allow its electric fleet to spread increasingly throughout all Italian regions. This commitment is also strengthened in relation to the initiatives undertaken by the Group to support small Municipalities. In this regard, the company aims to offer zero-emissions services in 800 small Municipalities and 35 historical centres by 2024. Poste Italiane has also expanded its range of services by entering the energy sector, with a 100% green product produced exclusively in Italy from renewable sources and certified through guarantees of origin. This project allows the Group to correlate green transition issues with those of innovation and digitalisation, while representing a major opportunity for sustainable development at national level Finally, the new Polis Project envisages the implementation at Post Offices of interventions aimed at environmental sustainability and social growth of communities. In particular, it is planned to install 5,000 thousand charging stations for electric vehicles and 1,000 photovoltaic systems that will contribute to the reduction of CO2 emissions, 1,000 outdoor spaces equipped to host cultural, health and wellness initiatives, and 4,800 smart building systems and environmental monitoring sensors. In addition, by providing the possibility to access public administration services from a One-Stop Shop and through the creation of co-working spaces, the movement of citizens and the consequent congestion of roads and public offices will be reduced, allowing the reduction of CO2 emissions. |

|

| Pillars impacted | Opportunities:

|

||

|

Green transition Environmental impacts of logistics |

||

|

Value for local communities Support for the socio economic development of local communities |

||

|

Innovation Innovation and digitisation of products, services and processes |

||

|

Customer experience Quality and Customer experience Cybersecurity, IT Security and Privacy |

||

| Capitals impacted: | |||

|

Intellectual | ||

|

Financial | ||

|

Physical-structural | ||

|

Social-relational | ||

|

Natural | ||

4. REPUTATION

| RISK | POTENTIAL SIGNIFICANT IMPACTS FOR POSTE ITALIANE | MAIN RISK MANAGEMENT ACTIONS AND TOOLS | |

|---|---|---|---|

| Activities carried out by the Company or counterparties that could impact negatively on climate, with consequent damage to its reputation Time frame: Long term |

Negative impacts:

|

As part of the risk management model, the Group considers both the possible impacts that climate change-related phenomena may have on the business of Poste Italiane (indirect impact) and those that the Company’s activities may have on the climate (direct impact). The process of identifying and assessing risks and environmental management methods also extends to counterparties (suppliers, business partners, other companies), impacting the procurement processes and any extraordinary finance transactions, providing, among other things, for the identification of suppliers and partners that may present risks related to environmental protection, also through a multi-dimensional analysis that takes into account parameters such as: possession of environmental, quality and energy performance certifications and adoption of environmental management systems, ethical standards of conduct and Minimum Environmental Criteria (MEC). The correct identification and assessment of climaterelated risks and opportunities is also ensured by listening to stakeholders, who are periodically involved in the Multistakeholder Forums organised by Poste Italiane. They are also provided with a reporting system that allows them to bring any perceived risks to the attention of the Company. In line with its decarbonisation strategy and in implementation of the guidelines for the exercise of voting rights and engagement activities and for investment in sensitive sectors, Poste Italiane, through its subsidiaries Poste Vita and BancoPosta Fondi SGR, has joined Climate Action 100+, an international collaborative engagement initiative to raise awareness of climate change issues among the world’s largest greenhouse gas emitters. Poste Italiane is focused on pursuing sustainable development by continuing to invest in projects aimed at strengthening ESG initiatives. In order to reduce the direct impacts that Poste Italiane’s activities may have on the climate, the Company is constantly advancing the use of energy sources that do not use fossil fuels (e.g. solar energy from photovoltaic panels on buildings) and in the reduction of energy consumption (e.g. replacement of neon lamps and use of LEDs), also in order to cope with potential sudden changes in prices of energy among others, Poste Italiane, in line with adherence to the Paris Agreement and the New Green Deal, has set itself the ambitious goal of making its contribution to the achievement of international carbon neutrality targets by 2030, well in advance of the timeframe defined by the European Union. |

|

| Pillars impacted: | Opportunities:

|

||

|

Integrity and transparency Working with integrity and transparency Legality and ESG integration in the procurement process |

||

|

Value for local communities Support for the socio economic development of local communities Dialogue and transparency with the authorities |

||

|

Green transition Environmental impacts of real estate facilities. |

||

| Capitals impacted: | |||

|

Human | ||

|

Intellectual | ||

|

Financial | ||

|

Physical-structural | ||

|

Social-relational | ||

|

Natural | ||

With regard to the assessment of physical risks, Poste Italiane's Governance dedicated to risk and sustainability, in line with what the IPCC has developed worldwide on climate projections, has updated its climate and water risk assessment methodology to have a clear picture of the risk and assessment of potential physical risks and opportunities. In this sense, the Company has conducted a precise assessment, including in the analysis all the Group's production and sorting sites located in different areas of Italy. Specifically, Poste Italiane, following an extensive analysis process that included the evaluation of the main Representative Concentration Pathways (RCP) of greenhouse gases, and the consistency of these pathways with the duration of assets and activities, identified and selected two scenarios: RCP 2.6 and RCP 8.5. The Group selects RCP 2.6 as the reference scenario, in line with the ambitious nature of the risk mitigation activities envisaged in the Business Plan in relation to the landscape identified by the IPCC. RCP 2.6 scenario envisages a peak in emissions at an early stage, followed by a subsequent decrease caused by the active removal of carbon dioxide within the atmosphere. RCP 2.6 is also known as RCP 3PD, in relation to the mid-century peak of ~3W/m², which will be followed by a significant decline. With the goal of zero greenhouse gas emissions by 2100, this scenario uses massive regulatory and policy intervention, leading to an almost immediate reduction in greenhouse gas emissions (GHG). The Company also considers the IPCC's RCP 8.5 scenario, as it provides an example of the worst-case scenario, i.e. the condition of a continuous increase in emissions during the course of the 21st century. RCP 8.5 pathway results from insufficient emission reduction efforts and represents a failure to stem warming by 2100. Regarding the climate projections for the two scenarios, in fact, for RCP 8.5, areas of the Mediterranean will experience an increase in temperature and a decrease in rainfalls, which will intensify in the second half of the century with an increasing trend until 2100. According to the RCP 2.6 scenario, on the other hand, there will be similar but smaller effects in the first half of the century, with a decreasing trend in the second half. This leads to a clear difference between the two scenarios in 2100

Poste Italiane carried out a risk assessment with the aim of assessing the potential impacts of physical events related to climate change on the business. The risk assessment considered the extent of the risk already existing at the sites and the future risk up to the year 2024 (medium-term scenario), under RCP 2.6 and RCP 8.5. In addition to the basic assumptions of the chosen models, the company also conducted a further study on the data from the rainfalls and main temperature parameters of the different scenarios, then comparing them with current data with the aim of determining the significance of the variation with respect to the existing risk at the sites examined, in line with the RCP 2.6 scenario and taking into account the possible implications of the RCP 8.5 worst case scenario. Future projections of changes in physical risk levels related to natural disasters are relevant in strategic terms, although in most cases there is still no certainty. On the other hand, excessive reliance on what is already known from climate science must be avoided. Therefore, Poste Italiane's risk assessment is appropriate to the increasing level of risk in its business and operations.The assessment of physical risks covers the entire revenue generated by the Group, amounting to €12 billion of existing operations in 2023, mainly from Post Offices and hubs, which are potentially most impacted by extreme weather conditions. Furthermore, with a view to a long-term time horizon, in line with the Business Plan and the 2030 Carbon Neutrality target, all new operations are subject to risk assessments that also take into account physical climate risks.The product result of the risk assessment is then converted into potential days of business interruption and then multiplied by the value in terms of lost revenue (€) of one day of business interruption. The main risks that emerged from the scenario analysis are those related to extreme weather events and changes in rainfall patterns. The greater severity of extreme weather events such as rain, storms, snowfalls and possible floods or frosts, with consequent landslides and floods, could cause interruptions in production, sorting and therefore logistics activities, as well as damage to sites and higher logistics costs. The negative impact of acute physical damage and interruptions in energy distribution is reflected on the financial performance of the group, influencing results and cash flows and leading to a deterioration of reputation [with consequent worsening of reputation] and loss of customer trust. One example of this was the severe flooding that occurred during the year in the regions of Emilia-Romagna and Tuscany, following which the Group cooperated with national and local institutions. These events caused damage to Poste Italiane's Post Offices, leading to the suspension of services. Precisely in consideration of a possible interruption of the activity, Poste Italiane carried out an analysis based on its production and sorting plants located in different areas of Italy. In this way, the Group was able to assess the potential financial impacts associated with climate events, compared to 2024. The sites with the highest potential financial impact due to flooding in 2024 are located in the regions of Northern Italy. In particular, the new hubs of Bologna and Landriano have been identified among the sites at greatest risk and which would lead to substantial loss of revenue in the event of business interruption, due to their operational importance. With reference to physical risks, the Group envisages specific mitigation measures in response to extreme weather conditions (e.g. landslides, avalanches, floods, etc.), which are detailed below

5. EXTREME WEATHER CONDITIONS (2)

| RISK | POTENTIAL SIGNIFICANT IMPACTS FOR POSTE ITALIANE |

MAIN RISK MANAGEMENT ACTIONS AND TOOLS | |

|---|---|---|---|

| Limited production, sorting and logistics, damage to sites and higher logistic costs due to extreme weather events such as rain, storms, snowfalls and possible floods or frost, with consequent mudslides and flooding Time frame: Medium term |

Negative impacts:

|

As part of its risk management model, the Group considers both the possible impacts that climate change phenomena may have on the business of Poste Italiane, identifying the main ways of managing them. In order to guarantee business operations even in the event of extreme weather conditions, Poste Italiane has adopted business continuity and disaster recovery plans in addition to actions aimed at preventing physical damage to structures. UNI EN ISO 14001 certification was maintained, providing for the systematic management of environmental aspects inherent to processes, from the perspective of improving environmental performance and making it more efficient, thus gaining significant benefits, also in terms of sustainability Furthermore, to prevent additional possible damage caused by extreme weather conditions, the Group has identified the regulatory perimeter for activating an environmental monitoring system, to determine the average annual concentration of radon gas in the air, based on assessing the risk of exposure to ionising radiation. Finally, for the coordination of emergency and recovery activities, Poste Italiane maintains dialogue with institutions (e.g. Civil Protection, Civil Defence) as well as interfacing with relevant bodies and international protection and defence organisations (e.g. participation in drills or other initiatives, etc.). |

|

| Pillars impacted | Opportunities:

|

||

|

Integrity and transparency Working with integrity and transparency |

||

|

Value for local communities Dialogue and transparency with the authorities |

||

|

People development Occupational health and safety |

||

| Capitals impacted: | |||

|

Human | ||

|

Intellectual | ||

|

Financial | ||

|

Social-relational | ||

(2) In the area of risk related to extreme weather conditions, the Group identifies and assesses both acute and chronic physical risks.

With a view to continually improving the management of climate and environmental factors and their impact on the various prudential risks, in early 2023, BancoPosta Fondi, PostePay and LIS Pay, as non-banking financial intermediaries, aligned themselves with the Bank of Italy's recommendations regarding "Supervisory Expectations on Climate and Environmental Risks". The three institutions therefore started working on an action plan to integrate climate and environmental risks (physical and transitional) into their governance and control systems, business model and strategy, organisational system and operational processes, risk management system and market reporting.