Background

For more than 160 years, Poste Italiane has taken a leading role in Italian financial savings with its Libretti di Risparmio Postale (Postal Savings Passbook), created in 1875, and Buoni Postali Fruttiferi (Postal Savings Bonds), from 1925. Over the decades, these products distributed by Poste Italiane have financed Italy’s major public works and economic development.

Over time, the way Italians save money has changed, less focused on a precautionary approach dictated by the need to set aside money for emergencies. Today, customers have different needs and a modern approach to investing.

Poste Italiane, therefore, has a key role to play in guiding this market transition, considering that the passbooks and postal bonds have earned the trust of 27 million Italians today. And the company has chosen to do so offering sustainable asset management products by integrating ESG (environmental, social and governance) considerations into investment choices.

This is a great responsibility for Poste Italiane, which operates in a country where financial literacy is below the international average. A study conducted by the Bank of Italy in 2023 found a slight improvement in the financial literacy of Italian adults compared to 2020. However, the overall score remains low, standing at 10.6 on a scale of 1 to 20. The research also highlights a poor mastery of digital finance skills, with the average score of Italians being 4.4 on a scale of 1 to 10.

Over time, the way Italians save money has changed, less focused on a precautionary approach dictated by the need to set aside money for emergencies. Today, customers have different needs and a modern approach to investing.

Poste Italiane, therefore, has a key role to play in guiding this market transition, considering that the passbooks and postal bonds have earned the trust of 27 million Italians today. And the company has chosen to do so offering sustainable asset management products by integrating ESG (environmental, social and governance) considerations into investment choices.

This is a great responsibility for Poste Italiane, which operates in a country where financial literacy is below the international average. A study conducted by the Bank of Italy in 2023 found a slight improvement in the financial literacy of Italian adults compared to 2020. However, the overall score remains low, standing at 10.6 on a scale of 1 to 20. The research also highlights a poor mastery of digital finance skills, with the average score of Italians being 4.4 on a scale of 1 to 10.

Poste Italiane’s commitment

Poste Italiane has for years now embarked on a substantial transformation journey that combines the evolution of customer needs, and thus Poste's products, with a path of strategic and sustainable transformation of Poste itself.

These are some of the key elements of the 'Strategic Plan 2024-2028' in continuity with the previous Plan launched in 2020. Poste Italiane is indeed continuing its commitment to sustainable economic and social development, also through the now advanced integration of environmental, social, and governance principles into Poste Vita and BancoPosta Fondi SGR's investment processes as well as the development of insurance products.

This means that Poste invests the savings of its customers in bonds issued by supranational and governmental bodies and in companies selected according to the following criteria:

These are some of the key elements of the 'Strategic Plan 2024-2028' in continuity with the previous Plan launched in 2020. Poste Italiane is indeed continuing its commitment to sustainable economic and social development, also through the now advanced integration of environmental, social, and governance principles into Poste Vita and BancoPosta Fondi SGR's investment processes as well as the development of insurance products.

This means that Poste invests the savings of its customers in bonds issued by supranational and governmental bodies and in companies selected according to the following criteria:

- Positive screening: to analyze and calculate the ability of each entity and related products to generate a positive social and/or environmental impact;

- Negative screening: to exclude from investments those entities and/or related products that are considered damaging to people and/or the environment.

Find out more about our Responsible Investment Policy.

Poste Italiane’s ESG journey

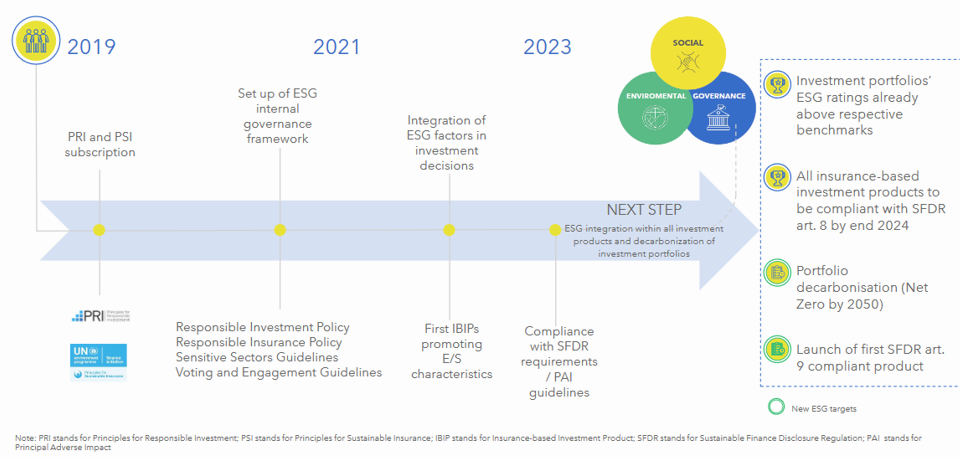

Given the growing emphasis on ESG issues in assessing investments and the adoption of a Sustainable Finance Action Plan by the European Commission in 2018, Poste Italiane wants to do its part. It embarked on its own ESG journey in 2018, which first involved the signing of the United Nations Principles for Responsible Investments (PRI) and Principles for Sustainable Insurance (PSI), followed by compliance with related policies and the implementation of specific guidelines and the integration of ESG criteria in insurance and investment products.

In this context, the introduction of policies aimed at covering responsible investment has contributed in giving value to its ESG journey. In fact, the latter have guided the Group in defining and identifying sustainability outcomes, in terms of making a positive contribution to ESG challenges – such as, for example, combating climate change, supporting human rights, and fighting corruption – as well as in measuring and monitoring the results produced by its sustainable investments.

Through, for example, key performance indicators declined in terms of resource efficiency related to the use of renewable energy, Poste Vita and BancoPosta SGR can monitor and measure the positive contribution of their investments in the context of the challenge of climate change.

In addition, intending to follow up on its ESG journey, the Group has set the goal of integrating ESG criteria for all Poste Vita products by 2024 and increasing ESG indicators against which BancoPosta Fondi SGR's investments portfolios can be monitored by defining a proprietary synthetic sustainability indicator by 2024.

Furthermore, Poste Italiane is included in some of the most important sustainability indexes and is subject to continuous monitoring and assessment processes by the most globally prominent ESG rating companies.

In this context, the introduction of policies aimed at covering responsible investment has contributed in giving value to its ESG journey. In fact, the latter have guided the Group in defining and identifying sustainability outcomes, in terms of making a positive contribution to ESG challenges – such as, for example, combating climate change, supporting human rights, and fighting corruption – as well as in measuring and monitoring the results produced by its sustainable investments.

Through, for example, key performance indicators declined in terms of resource efficiency related to the use of renewable energy, Poste Vita and BancoPosta SGR can monitor and measure the positive contribution of their investments in the context of the challenge of climate change.

In addition, intending to follow up on its ESG journey, the Group has set the goal of integrating ESG criteria for all Poste Vita products by 2024 and increasing ESG indicators against which BancoPosta Fondi SGR's investments portfolios can be monitored by defining a proprietary synthetic sustainability indicator by 2024.

Furthermore, Poste Italiane is included in some of the most important sustainability indexes and is subject to continuous monitoring and assessment processes by the most globally prominent ESG rating companies.

Three key points

Sustainable Investment Fund

Poste Investo Sostenibile is a bond for those who want to invest responsibly in the promotion of ESG impacts and do their part for a future rooted in long-term sustainable growth.

The result of a 30-year partnership in the field of responsible investments between BancoPosta Fondi SGR and Amundi SGR, the fund takes a prudent approach and is based on solid geographic and market diversification.

This is an example of a product that gives Poste Italiane customers the chance to invest in stock and bond markets with an ESG focus.

Moreover, as part of its activity as an Asset Manager in the market, and aware of its role, BancoPosta SGR offers clients different types of sustainable investment products and services, representative of specific characteristics and classifiable into different ranges of investments.

Find out more about the sustainable investment products and services offered by BancoPosta Fondi SGR in 2023