Highlights (as of 31 December 2023)

12,755

Post Offices throughout the country

4

Automated hubs

183,7 m

Digital channel transactions

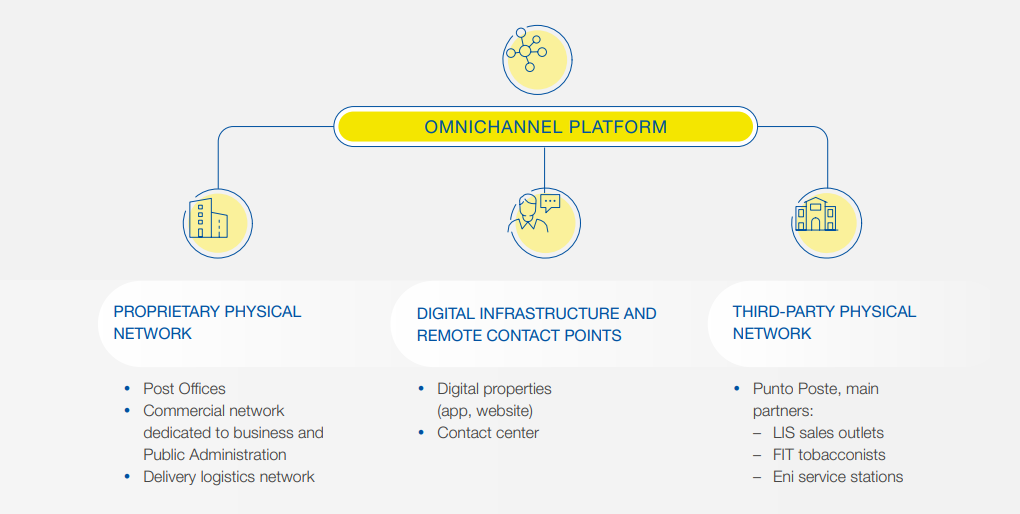

Omnichannel strategy

This integrated omnichannel platform enables us to monitor customers and the supply of services through three channels:

- Proprietary physical network: namely the Post Offices, the business customer sales force and the logistics network for mail and parcel delivery.

- Digital infrastructure and remote contact points: all the Group's digital properties and the contact centre, serving the entire national population. As part of the 2024-2028 Strategic Plan we are taking a step further by launching a new SuperApp, set to become the main access point to the platform.

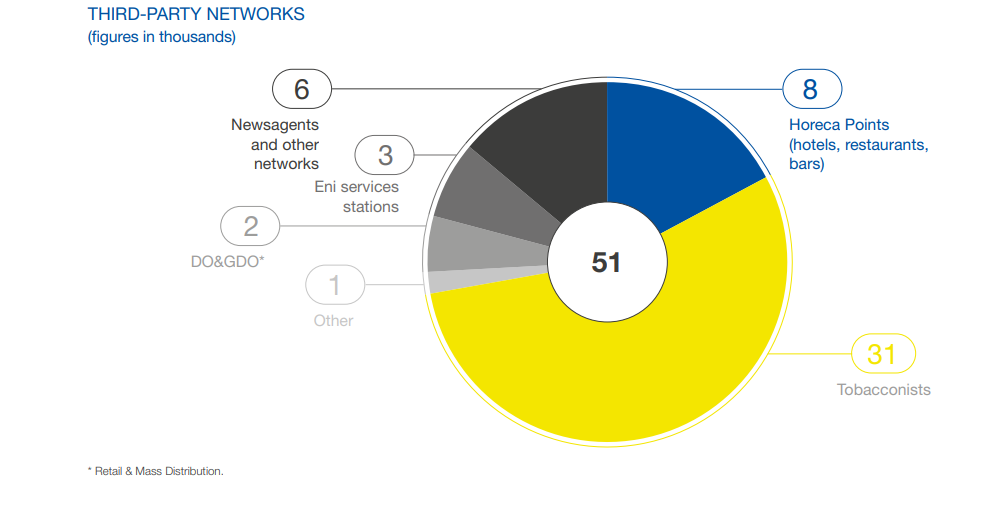

- Third-party physical network: with approximately 51,000 contact points, this is the result of business partnership agreements for the marketing Group products and services.

The physical network

The Post Offices

|

|

|

|||

|---|---|---|---|---|

| Unit | Personnel | Unit | Personnel | |

| Macro Areas Post Office Network | 6 | 0.5 | 6 | 1.1 |

| Branch offices | 132 | 4.2 | 132 | 3.6 |

| Post Offices | 12,755 | 47.4 | 12,755 | 49.3 |

| Total | 12,893 | 52.1 | 12,893 | 54.0 |

Polis Project

Distribution of post offices and branches throughout the territory

Seleziona

x Branch Offices

y Post Offices

|

Regions |

Postal Offices |

Branches |

|---|---|---|

|

Abruzzo |

473 |

4 |

|

Basilicata |

180 |

2 |

|

Calabria |

617 |

6 |

|

Campania |

951 |

9 |

|

Emilia-Romagna |

891 |

10 |

|

Friuli-Venezia Giulia |

331 |

4 |

|

Lazio |

788 |

9 |

|

Liguria |

426 |

5 |

|

Lombardia |

1,871 |

19 |

|

Marche |

406 |

5 |

|

Molise |

167 |

2 |

|

Piemonte |

1,385 |

12 |

|

Puglia |

471 |

5 |

|

Sardegna |

441 |

4 |

|

Sicilia |

769 |

12 |

|

Toscana |

900 |

11 |

|

Trentino-Alto Adige |

323 |

2 |

|

Umbria |

262 |

2 |

|

Valle d'Aosta |

71 |

1 |

|

Veneto |

1,032 |

8 |

The logistics network

As part of the transformation plan for the Correspondence and Parcels segment and with the aim of becoming an integrated logistics operator, the Group launched an important development towards in 2023: third-party management of customers' warehouse goods and delivery activities. We will continue along this route with the 2024-2028 Strategic Plan: in the future, the postal network will be increasingly oriented towards parcel handling.

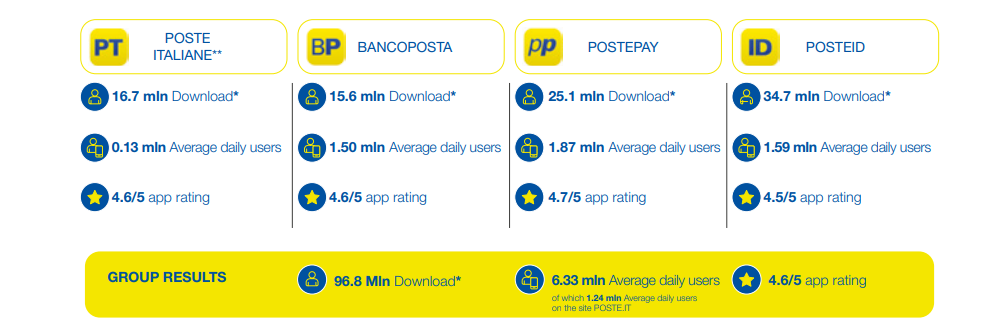

Digital properties: web, app and contact centre

Within the 2024-2028 Strategic Plan, the Group plans a new evolution of our digital channels. More specifically, we will establish a customised SuperApp, which will incorporate the new payment wallet and provide a single point of access to our ecosystem. We started this process in 2023, equipping the current Poste Italiane app with new functionalities, which is then destined to become the Group's only app. We will progressively converge all Poste Italiane's services into this single asset in order to ensure a simple, intuitive and customer-centric user experience.

* Stock since launch. The value reported in the Group Results column includes downloads of the no longer available Postemobile app.

** On 10 October 2023, the Ufficio Postale app was renamed Poste Italiane app.

Our digital channels - which also include the poste.it website, the Group's consumer and business portal - will be increasingly important, in part due to the significant technological investments made to foster a real omnichannel experience and expand the range of products and services that can be purchased directly through our digital properties.

In addition, in 2023:

- Poste Italiane's digital web and app channels were the access point to online services for 39 million retail users.

- 69% of Poste Italiane's daily interactions were handled through remote channels and third-party networks.

- Poste Italiane was confirmed as the top SPID Digital Identity Manager, with a market share of around 75% and a customer base of around 27.3 million public Digital Identities issued, of which 24 million are active.

Third-party physical network

The objective is twofold:

- To create a platform for the integration of the Group's products with third-party distribution channels.

- To use third-party services within the Group's commercial offers, also introducing innovative services with high added value.

We have contracted an extensive network of contact points – 51,000 in 2023 - further strengthened with the acquisition of LIS holding.