Rome, 2 Aug 2018 05:30

- Group Revenues reached €2.5bn in 2Q18 and €5.4bn in 1H18 (-4.5% vs 2Q17, -1.3% vs 1H17)

- Operating Costs at €2.2bn in 2Q18 and €4.4bn in 1H18 (-6.4% vs 2Q17, -5.9% vs 1H17) supported by lower FTEs and focus on efficiency

- EBIT significantly up in 2Q18 to €350m and €1.1bn in 1H18 (+9% vs 2Q17, +24.3% vs 1H17) with positive recurring operating progression of all segments

- Net profit strongly up at €250m in 2Q18 +57.2% vs 2Q17 and €735m in 1H18 +44.1% vs 1H17 thanks to improved operating results (EPS at €0.56 in 1H18)

- B2C volumes increased by a strong 40% in 1H18 with the inclusion of international packets booked in the Mail line

- Total Financial Assets reached €510bn in June 2018, up €4bn from 2017 due to positive net inflows of €4.4bn in 1H18 driven by life insurance, deposits, and mutual funds

- 2018 targets confirmed for the Group and all segments with Deliver 2022 key initiatives implemented

| POSTE ITALIANE GROUP 1H 2018 | |

|---|---|

| Group Highlights |

Revenues at €5,429m (-1.3% vs 1H17) EBIT at €1,053m (+24.3% vs 1H17) Net Profit at €735m (+44.1% vs 1H17) |

| Mail, Parcel & Distribution |

Revenues at €1,761m (-2.8% vs 1H17) EBIT at €184m (+145% vs 1H17) Net Profit at €114m |

| Payments, Mobile & Digital |

Revenues at €307m (+10.4% vs 1H17) EBIT at €101m (+6.3% vs 1H17) Net Profit at €77m (+10.0% vs 1H17) |

| Financial Services |

Revenues at €2.676m (-1.3% vs 1H17) EBIT at €408m (+24.8% vs 1H17) Net Profit at €293m (+25.2% vs 1H17) |

| Insurance Services |

Revenues at €685m (-1.9% vs 1H17) EBIT at €360m (+2.9% vs 1H17) Net Profit at €251m (+7.7% vs 1H17) |

| POSTE ITALIANE GROUP 2Q 2018 | |

|---|---|

| Group Highlights |

Revenues at €2,545m (-4.5% y/y) EBIT at €350m (+9.0% y/y) Net Profit at €250m (+57.2% y/y) |

| Mail, Parcel & Distribution |

Revenues at €863m (-3.9% y/y) EBIT at -€79m (-31.7% y/y) Net Profit at -€60m (+43.9% y/y) |

| Payments, Mobile & Digital |

Revenues at €164m (+10.8% y/y) EBIT at €44 (+10.0% y/y) Net Profit at €34m (+9.7% y/y) |

| Financial Services |

Revenues at €1,157m (-7.3% y/y) EBIT at €169m (+24.3% y/y) Net Profit at €120m (+21.2% y/y) |

| Insurance Services |

Revenues at €361m (-2.7% y/y) EBIT at €216m (+5.4% y/y) Net Profit at €156m (+14.7% y/y) |

Rome, 2 August 2018, yesterday the Board of Directors of Poste Italiane S.p.A (or “the Group”) approved First Half 2018 financial results underpinned by a continued positive progression towards Deliver 2022, the five-year strategic plan aimed at unlocking the value of the Group’s unique distribution network capabilities.

Commenting on the results, Matteo Del Fante, Poste Italiane’s Chief Executive Officer and Managing Director said: “Poste Italiane is solidly progressing in line with our Deliver 2022 targets. The second quarter results confirm the early positive impact of the plan’s execution. I am very pleased with the early results of the roll-out of the Joint Delivery Model, characterized by a flawless implementation. We offer, amongst other, evening and weekend deliveries. We are efficient and competitive in the eCommerce space with a range of products for B2C customers, that is why Amazon chose us as a long-term partner. I am proud to have partnered with FIT1 in order to further enhance eCommerce penetration in Italy with the reach of their points of sale allowing us to keep a solid grip on our market position. We are building on the fact that 1 in 3 parcels in Italy are delivered by Poste Italiane, whilst 1 in 4 purchases on line are paid with Postepay cards. Our leadership in eCommerce is positioned to further strengthen with Deliver 2022, with B2C volumes increasing by 40% in the first half of the year including international packets.

We are also seeing very positive results in our group-wide digital vision which is accelerating with our e-money institution due to go-live by the end of the year.

People are key to our strategy and we will offer 20 million training hours over the plan for all our colleagues, and we are also in the process of hiring 500 university graduates for Customer Relationship Manager roles across our unique 12,800 strong branch network.

We have signed successful third party asset management and loans/mortgages distribution agreements with positive results leveraging our trusted, extensive branch network reaching all Italian municipalities, be they large or small. Our controlled open platform and distribution model is up and running with a focus on IT systems and staff training.

Deliver 2022 execution and monitoring is our daily focus. We will continue to aim high, making sure to provide quality products and services that meet our customers’ evolving needs.

Our 2018 targets are confirmed for both the group and each business unit.”

***

In addition to the standard financial indicators required by IFRS, Poste Italiane also utilises a number of alternative performance indicators, with a view to providing a clearer assessment of the business performance and financial position. The meaning and makeup of such indicators are described in the annex, in line with the ESMA/2015/1415 Guidelines of 5 October 2015.

***

DELIVER 2022 – UPDATE

Since the launch of Deliver 2022 in February 2018, Poste Italiane is continuing its progress across the business with a number of developments:- Mail, Parcel & Distribution

- Roll out of the Joint Delivery Model progressing flawlessly, with 226 delivery centers already reorganized to date (65% of 2018 target)

- A 3+2 year non-exclusive agreement with Amazon leveraging on our competitive product offering, including evening and weekend deliveries. Our air carrier Mistral Air and express courier SDA constitute further competitive advantages

- B2C volumes continued progression in 1H18 with a 40% increase including international packets

- An agreement with FIT to be part of the PuntoPoste2 network regarding eCommerce deliveries and returns as well as posting pre-paid parcels.

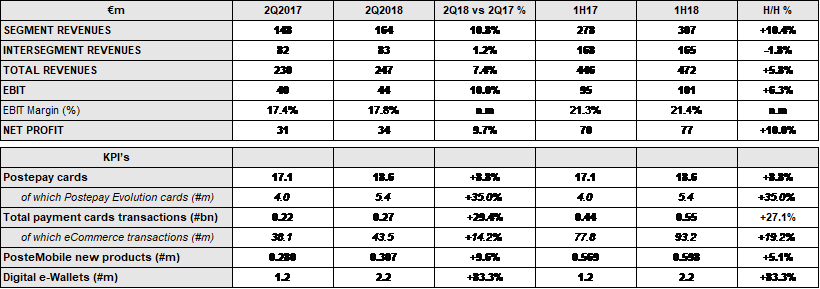

- Payments, Mobile & Digital

- E-money institution go-live expected in October 2018, poised to seize market opportunities from the evolution of payment systems towards digital channels

- ”Paga con Postepay” launched in May for eCommerce merchant payments

- Total payment cards transactions at €0.55bn in 1H18 (+27% y/y)

- Total PostePay Evolution cards at 5.4m in 1H18 (+35% y/y)

- Postepay Digital E-Wallets at 2.2m in 1H18 (+83% y/y)

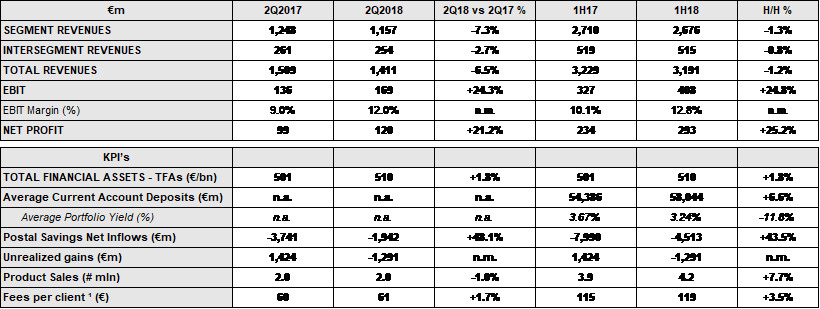

- Financial Services

- New distribution agreements with Anima and Intesa have contributed to a solid growth in asset management products leading to positive net inflows.

- Loans and mortgages volumes increased 26.2% in the second quarter. In Q2 adjusted revenues3 were up by 45.8% to €70m and are poised to grow further in 2H18 supported by distribution agreements with Intesa.

- On 31 July 2018 Poste Italiane signed a new distribution agreement with UniCredit on salary backed loans, a profitable segment of the market, further supporting our targets for 2022.

- 500 university graduates being hired in 2018 as Relationship Managers across the network.

- Adjusted revenues4 in financial services revenues up 7.6% with a more sustainable mix leveraging on our distribution capabilities.

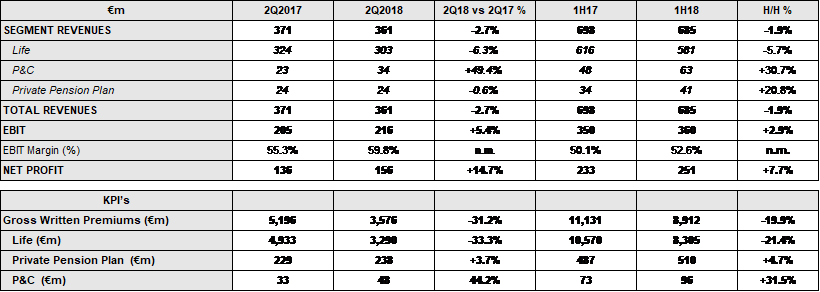

- Insurance Services

- The insurance business for FY18 is expected stable y/y, with an on-going rebalancing of revenues towards P&C, unit linked and multi-assets products.

- Enhancing of product offering (new class I and multi-asset life insurance products, earthquake/natural disasters and home insurance products)

- Group

- Cost discipline confirmed: 1H18 costs down by 5.9% h/h to €4.4bn and down 6.4% y/y

- Cost base in line with 2018 target including the €0.4bn early retirement charges expected for 4Q18

- HR Costs: €1.4bn in 2Q18 (-2.6% q/q) and €2.8bn in 1H18 (-3% h/h) supported by approximately 2,700 lower average FTE’s y/y

- Non HR operating costs: €779m in 2Q18 (-12.5% q/q) and €1.5bn in 1H18 (-10.9% h/h)

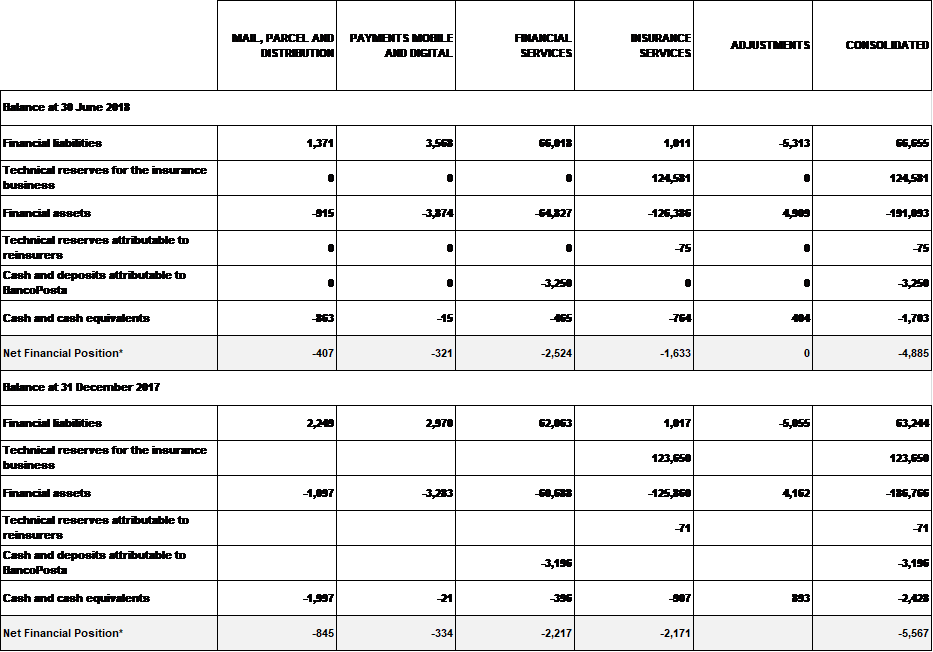

- Net financial position of Mail, Parcel and Distribution: €407m surplus after paying a €549 million dividend to our shareholders

1H18 FINANCIAL RESULTS – GROUP BREAKDOWN

REVENUES IN LINE WITH DELIVER 2022 PROJECTIONS

Group revenues totalled €5.4bn in 1H18 (-1.3% vs 1H17). The Payments, Mobile & Digital segment continues to report very positive results at €307m or a 10.4% increase on 1H17 mainly thanks to card payments. Mail, Parcel & Distribution revenues in 1H18 were down 2.8% to €1.8bn with parcel revenues mitigating lower mail revenues. In the Financial Services segment, net of non-recurring items5, 1H18 results show a positive progression, well on track with Deliver 2022.Revenues for Insurance were down 1.9% in 1H18: life products revenues were down to €581m (-6% h/h). Both P&C increased strongly to €63m (+32% h/h) and Private Pension Plans to €41m (+21% h/h) and the overall trend is in line with the rebalancing envisaged in Deliver 2022. P&C growth is in fact recording a faster growth compared to the Italian market.

GROUP COSTS DOWN THANKS TO CONTINUED EFFICIENCY MEASURES

Overall group costs amounted to €4.4bn in 1H18, down by almost 6% h/h and in line with the cost base expected for 2018. Non HR Operating Costs (including depreciation and amortization) are down 10.9% to €1.5bn mainly as a result of lower costs of goods and services and lower provisions. HR costs are down 3.0% or €88m h/h thanks to lower FTE’s and a temporary effect on cost per FTE6. The average headcount reduction presented as part of the Deliver 2022 strategic plan continues with average total FTEs down to 135,284 in 1H18 (1H17 equal to 137,970). Labour costs per FTE also registered a 1.9% reduction in 1H18 h/h to €41.8 thousand, in line with 2018 target.OPERATING PROFITABILITY AS ENVISAGED IN THE STRATEGIC PLAN

EBIT reached a healthy €1.1bn significantly up by 24.3% vs. 1H17, with growth across all segments thanks to a continued focus on efficiency. Payments, Mobile & Digital operating profit grew to €101m in 1H18 (+6.3% h/h); Financial Services EBIT increased to €408m (+24.8% h/h) and Insurance Services were up to €360m (+2.9% h/h). Mail, Parcel & Distribution grew strongly to €184m in the first half of the year.TOTAL FINANCIAL ASSETS

At June 2018, Total Financial Assets7 reached €510bn (+€4bn from December 2017) sustained by €4.4bn positive net inflows in the first half of the year supported by life insurance, deposits and mutual funds. In particular, average assets under management have increased by 10.8% to almost €9.5bn including mutual funds (€8bn) and €1.5bn unit linked and multiassets Class III insurance products. Insurance represented €4.9bn net inflows, driven by €4.6bn segregated funds (Class I–V). Net inflows in mutual funds, unit linked and multi-assets Class III insurance products amounted to €710m in the first half of the year.Postal savings negative net inflows continued to improve reaching -€4.5bn thanks to new commercial initiatives, mitigated by €3.7bn positive effect related to the accrual of interests on postal bonds. In the second half 2018 postal savings are expected to show a stronger performance supported by traditional positive seasonality.

1H18 FINANCIAL RESULTS – BUSINESS SEGMENT BREAKDOWN

MAIL, PARCEL & DISTRIBUTION – ONGOING REFOCUS IN LINE WITH PLAN

Mail, Parcel & Distribution recorded a -2.8% reduction in total third party revenues to €1.8bn in 1H18. Mail revenues accounted for a -3.4% decline in 1H18 greatly improving on the result recorded in 1H17 of -6.7%. Declared cost discipline is continuing in line with 2018 targets leading to an EBIT of €184m in 1H18 up 145% h/h (-€79m in 2Q18 vs. -€60m in 2Q17). 1H18 EBIT benefits from €0.3bn capital gains booked in 1Q18, while €0.4bn early retirement charges are expected in 4Q18. Thus the target of €0.4bn operating loss for 2018 is confirmed.

The performance of mail revenues was in line with our strategic plan, resulting in €1.3bn in 1H18 (-3.4% h/h) and €632m in 2Q18 (-4.7 % y/y).

Mail volumes stood at 1.6bn pieces (-3.4% h/h) and 759m pieces in 2Q18 (-3.8% y/y),

Average mail prices were up 1% in 1H18 while where stable in 2Q18.

Parcel revenues continue to rise, reaching €352m in 1H18 up 2.9% vs last year (€177m in 2Q18, +5.4% y/y) with particularly positive results in the B2C segment (up 21.7% in 1H18) where Poste Italiane is confirming its market leadership and is poised to further improve by leveraging on the roll-out of the Joint Delivery Model and the recently signed agreements with Amazon and FIT. Quarter on quarter results in the B2B segment show signs of recovery from industrial actions that affected the segment towards the end of 2017.

Average parcel prices were down about 3.5% in the quarter and 4% in the half, reflecting the changing volume mix from C2C/B2B to B2C.

In terms of volumes, 59 million parcels were delivered in the first half of the year, up 7.3% compared to the first half of 2017, underlining Poste Italiane as partner of choice in the eCommerce market and expected to continue to play an increasingly pivotal role in this space in Italy. B2C volumes increased by a strong 40% in 1H18 with the inclusion of international packets booked in the mail line.

PAYMENTS, MOBILE AND DIGITAL – CONTINUED GROWTH

Payments, Mobile & Digital revenues were equal to €307m in 1H18 growing 10.4% h/h, supported by all business lines (€164m in 2Q18, +10.8% y/y). In Card Payments, revenues increased to €122m in 1H18 (23% h/h) mainly supported by increasing PostePay cards, standing at 18.6m at the end of June. In particular higher margin PostePay Evolution cards amount to 5.4m at the end of June (+35% y/y). Total payment cards transactions were up to 0.55bn (+27.1% y/y) of which over 93m were eCommerce transactions in 1H18. Telecoms revenues increased 6% h/h supported by the launch of new mobile and fixed lines products.Deliver 2022 KPIs are all on track: Digital e-Wallets are up a substantial 83.3% to 2.2m users. New telecom customers (both fixed and mobile lines) were 598 thousand (+5.1% h/h).

EBIT reached a solid €44m in 2Q18 (+10% q/q) reaching €101m in the first half of the year (+6.3% h/h), enabling us to confirm our 2018 targets.

This business is pivotal in delivering Poste Italiane’s digital vision. All the digital assets of the group are showing robust growth with comparable daily digital users (almost 1.4m) and daily post office visitors (1.5m people), with the integration of digital and physical customer journeys. These results are tangible signs in the process supporting Poste’s E-Money institution launch that will go live by October 2018.

FINANCIAL SERVICES – IMPROVING IN LINE WITH PLAN

Financial Services segment revenues reached almost €2.7bn8, down 1.3% h/h (€1.2bn in 2Q18, -7.3% y/y) impacted by lower capital gains. Total revenues for the segment excluding non-recurring items were up 7.6% in 1H18 and +7.2% on a quarterly basis. Fees from postal savings increased to €444m in 2Q18 (+7% y/y) leading to €894 in the first half of the year (+16% h/h), benefitting from the new distribution agreement with CDP and a renewed commercial focus on a product which is key for Poste.

Interest income reached €386m in 2Q18 (+7% y/y) and €747m in 1H18 (+3% h/h) thanks to higher average volumes offsetting the negative impact of lower rates.

Loan and mortgage distribution fees were impacted by a change in accounting principles (IFRS15) and the disposal of Banca del Mezzogiorno-MCC. Net of these effects quarterly results were up to €70m 2Q18 (+45.8% y/y) leading to €128m in 1H18 (+28.0% h/h). Revenues are growing even faster than volumes thanks to the new distribution agreements and some re-pricing of the existing ones.

Assets under management increased supported by positive net inflows, growing at a faster pace than the market. Mutual funds fees amounted to €22m in 2Q18 reaching €44m in 1H18 with running management fees increasing faster than assets under management. Poste Italiane has completed MIFID II guided advisory training and certification in all branches.

Operating profit performed positively with €169m in 2Q18 up 24.3% y/y reaching €408m in 1H18 up 24.8% h/h.

INSURANCE SERVICES - OPERATING RESULTS IN LINE WITH DELIVER 2022

Operating profitability increased thanks to P&C contribution. As a result EBIT amounted to €216m in 2Q18 up 5.4% y/y, reaching €360m in 1H18 up 2.9% h/h.

From a KPI perspective Gross Written Premiums in life products are down by 21% y/y, while unit linked and multi-asset premiums steadily increased. Gross Written Premiums for private pension plans increased by 4.7% in 1H18 to €510m while the P&C business increased by 32% to €96m supported by all business lines: welfare, personal, property and payment.

Gross Written Premiums trends are in line with 2018 targets, envisaging lower premiums for €3bn and resilient operating results.

Since December 2017 life products recorded positive net inflows for over €4.9bn, thanks to €4.6bn in segregated funds, €0.5bn in private pension plans and €0.3bn multiassets, whilst unit linked and index linked products registered negative net inflows for €0.4bn as a result of expiring index linked policies that are no longer offered.

The Group confirmed a solid capital position with a Solvency II Ratio of 185% at the end of June, impacted by market volatility, especially on government bonds. The ratio remains well above regulatory requirements and the risk tolerance set by the internal Risk Appetite Framework.

It is important to note that the sensitivity to further government spread widening reduced significantly thanks to volatility adjustments which would be triggered (+100bp higher spread would result into -27p.p. Solvency II ratio at the end of June 2018 as opposed to -60p.p. at the end of December 2017).Insurance is confirming the effectiveness of business operations in line with strategic objectives set out in Deliver 2022, targeting a resilient operating profitability in 2018 y/y.

RECENT EVENTS AND BUSINESS OUTLOOK

SIGNIFICANT EVENTS DURING AND AFTER 1H2018

On 7 August 2017, Poste Italiane completed the sale of its 100% interest in Banca del Mezzogiorno-Medio Credito Centrale to Agenzia nazionale per l’attrazione degli investimenti e lo sviluppo d’impresa (Invitalia) for a total consideration of approximately €387 million, including €317 million collected at 30 June 2018. The remaining amount is to be collected in tranches, the last of which five years from the date of the agreement.On 6 March 2018, Poste Italiane SpA and Anima Holding SpA, together with Poste Vita SpA, BancoPosta Fondi SpA SGR and Anima SpA SGR, to the extent of their respective responsibilities, signed implementing agreements designed to strengthen their partnership in the asset management sector, in accordance with the terms and conditions in the agreement of 21 December 2017.

The transaction envisages the partial spin-off of management of the assets underlying Poste Vita SpA’s Class I insurance products (totalling over €70 billion), previously attributed to BancoPosta Fondi SpA SGR, to Anima SpA SGR and extension of the partnership that will have a duration of 15 years. Following the transaction, Poste Italiane will retain its 100% interest in BancoPosta Fondi SGR, with the aim of creating a competence centre to manage all the Group’s financial investments. The transaction will also enable the Company to boost training and refresher courses for Poste Italiane’s distribution network, in relation to asset management, and to expand the range of products offered to savers.

On 12 April 2018, Poste Italiane implemented the decision taken by its Board of Directors on 25 January 2018, subscribing for its share of the rights issue carried out by Anima Holding SpA, amounting to a total of approximately €30 million. This has enabled the Company to retain its 10.04% interest in Anima Holding SpA.

On 19 April 2018, the Board of Directors of BancoPosta Fondi SGR SpA approved the planned spin-off and the application for authorisation to be submitted to the Bank of Italy, which granted clearance on 11 July 2018.

With the aim of more effectively driving growth in the payment services market and strengthening the service offering for retail, business and Public Administration customers, Poste Italiane has decided to combine the Poste Italiane Group’s distinctive expertise and competencies in the field of mobile and digital payments in one specialist entity.

This will involve the contribution in kind to PosteMobile SpA of the e-money and payment services operated by BancoPosta RFC and PosteMobile’s establishment of a separate ring-fenced entity to specialise in e-money and payment services, and through which PosteMobile SpA will be able to operate as an electronic money institution, whilst also continuing to operate as a mobile virtual network operator.

The transaction, together with the proposed change to BancoPosta RFC and to its By-laws, and the grant of the related authority to submit a request for authorisation to the Bank of Italy, was approved by Poste Italiane’s Board of Directors on 25 January 2018.

Following the receipt of authorisation from the Bank of Italy on 24 April 2018, the Extraordinary General Meeting of Poste Italiane’s shareholders held on 29 May 2018 approved the proposed removal, from the ring-fence that applies to BancoPosta RFC, of the assets, contractual rights and authorisations that make up the e-money and payment services unit. Poste Italiane is providing the Bank of Italy with regular updates on the related implementation of information systems. The same General Meeting also approved removal, from the ring-fence of the contractual rights and authorisations relating to back office and anti-money laundering activities.

On 29 May 2018, the Ordinary and Extraordinary General Meeting of Poste Italiane SpA’s shareholders authorised the Company to purchase and hold up to 65.3 million of the Company’s ordinary shares, representing approximately 5% of the share capital, at a total cost of up to €500 million. Purchase of the treasury shares will be permitted for eighteen months from the date of the shareholder resolution granting the authority. There is, in contrast, no limit on the period of time in which the treasury shares will be at the Company’s disposition. The General Meeting also, as proposed by the Board of Directors, defined the purposes, terms and conditions for the purchase and sale of treasury shares, establishing the methods for calculating the purchase price, and the operating procedures for carrying out purchases.

Following on from the Board of Directors’ resolution of 25 January 2018, and following the receipt of prior authorisation from the Bank of Italy in April, on 29 May 2018, the Extraordinary General Meeting of Poste Italiane SpA’s shareholders approved Poste Italiane SpA’s proposed injection of fresh capital of €210 million into BancoPosta RFC in order to return its leverage ratio to within the threshold set in the Risk Appetite Framework. This transaction will take place in the third quarter, once the deadline for creditors to file their opposition has passed.

The following material events also took place during the first half of 2018:

• On 25 January 2018, Poste Italiane SpA’s Board of Directors authorised payment to SDA Express Courier SpA of a total of €40 million to cover the losses incurred through to 31 December 2017, and to recapitalise the company and establish an extraordinary reserve. SDA Express Courier ended the first half of 2018 with a capital deficit of €10.4 million, thereby falling within the scope of art. 2447 of the Italian Civil Code (a reduction in capital to below the legal minimum). As a result, the value of Poste Italiane SpA’s investment is zero and SDA’s Board of Directors has called an Extraordinary General Meeting of shareholders to decide on the company’s recapitalisation.

• On 13 February 2018, the deed for the merger of PosteTutela SpA (a wholly owned subsidiary of Poste Italiane SpA) with and into Poste Italiane was executed. The transaction will be effective for legal purposes from 1 March 2018, and for accounting and tax purposes from 1 January 2018.

• On 19 February 2018, Poste Italiane SpA’s Board of Directors approved an initiative designed to protect customers of the Europa Immobiliare 1 fund. On 28 March 2018, the manager of the fund, Vegagest SGR, announced to the market that it had provisionally suspended the resolution approving the final liquidation financial statements and, on 13 June 2018, approved the partial repayment to quotaholders of 50% of the final liquidation value. Subsequently, on 28 June 2018, Poste Italiane’s Board of Directors reviewed the above initiative designed to protect customers, with the resulting impact on risks and charges at 30 June 2018 of amounting to approximately €17 million.

Finally on 31 July 2018, Poste Italiane signed a letter of intent with Unicredit, with the aim of developing partnerships in the consumer credit market. The initial agreement concerns the promotion and sale, through the post office network, of salary and pension backed loans, underwritten by UniCredit specifically for public and private employees and pensioners, with the possibility of extending the agreement, at a later date, to include personal loans.

In line with Deliver 2022, Poste Italiane’s five-year strategic plan, this agreement marks a continuation of the Company’s drive to establish partnerships with leading banking groups, with the aim of further expanding the range of products and services distributed through its widespread network to over 34 million customers. The agreement is designed to take advantage of UniCredit’s extensive expertise in consumer lending.

BUSINESS OUTLOOK

In the second half of 2018, the Poste Italiane Group will be engaged in implementing the objectives outlined in the five-year Deliver 2022 Plan, approved by the Board of Directors on 26 February 2018. The strategic objective of the Group's Strategic Plan is to achieve physical and digital transformation, taking advantage of market trends and the recovering Italian economy.In the Mail, Parcels and Distribution segment, the Group will focus on progressive implementation of the new joint delivery model. The adoption of new automation technologies to support production processes will continue, with the aim of boosting the efficiency and quality of postal services, maximising synergies in the logistics and operations network and leveraging all the Group’s available assets. This strategy will also enable the Group to improve its competitive position in the parcels market by taking advantage of the opportunities arising from the growth of eCommerce.

With the creation of the new Payments, Mobile and Digital business unit, the Poste Italiane Group aims to become Italy's leading payments ecosystem, ensuring convergence between payments and mobile technology, and between physical and digital channels, by using its existing assets in terms of expertise, customer base and physical and digital networks.

In this competitive environment, and in view of the digital payment opportunities (in Italy cash is used in 85% of transactions, compared with an EU average of 68%), on 25 January 2018, Poste Italiane SpA’s Board of Directors approved the separation and transfer of certain assets, contractual rights and authorisations from BancoPosta RFC to a new ring-fenced e-money and payment services unit to be set up within PosteMobile SpA. This will enable the latter to operate as an e-money institution. Following the receipt of authorisation from the Bank of Italy on 24 April 2018, the Annual General Meeting of Poste Italiane’s shareholders, held on 29 May 2018, approved the proposed removal of the ring-fence that applies to BancoPosta RFC from the assets, contractual rights and authorisations that make up the e-money and payment services unit.

The above changes will be effective from 1 October 2018.

In the Financial Services segment, the Plan aims to take advantage of the opportunities arising from recent regulatory innovations (MiFID II and IDD), taking advantage of current strengths: customer base, distribution network and brand. At the same time, Postal Savings will benefit from the new agreement with Cassa Depositi e Prestiti signed in December 2017. In addition, the active management strategy for the financial instruments portfolio is aimed at stabilising the overall return from interest income and realised capital gains.

Consolidation of the partnership with the Intesa San Paolo group as regards loans will lead to the launch of two new credit protection and insurance products providing cover for the mortgaged properties. The Group will begin marketing residential mortgages under the partnership with Intesa SanPaolo, enabling us to again develop a multi-partner strategy, completing the existing products offered in collaboration with Deutsche Bank.

In the Insurance Services segment, the Group intends to maintain its leadership in the life insurance business, by providing customers with the best products in the current economic and market environment, strengthening its pension fund offering, and continuing to develop private pension plans, an area in which the Group is already the market leader. In the non-life sector, the objective will be to pursue rapid growth in the accident, welfare and non-vehicle non-life sectors, taking advantage of strong untapped potential in these markets.

The bond markets witnessed prolonged falls in interest rates and spreads in the first six months of 2018, following by a sudden increase in the perception of sovereign risk for Italy following the uncertainty caused by the outcome of the general election of 4 March.

The sharp increase in volatility in May led to a very significant rise in the spread at the short-term end of the BTP curve.

The market currently appears to be biding its time, although it is reasonable to expect a period of BTP interest rate and spread volatility

MATURING BONDS

30 May 2019 is the expiry date of the bond loan issued by Poste Vita SpA on 30 May 2014 for a nominal value of € 750 million with a book value at 30 June 2018 of € 751 million.

ALTERNATIVE PERFORMANCE INDICATORS

The meaning and the content of alternative performance indicators, not provided for in IAS/IFRS, are described below. These indicators are used to provide a clearer basis for assessment of the Group’s operating and financial performance.EBIT MARGIN: is calculated as the ratio of operating profit (EBIT) to total revenue.

NET FINANCIAL POSITION OF THE GROUP: is the sum of financial liabilities, technical reserves for the insurance business, financial assets, technical reserves attributable to reinsurers, cash and deposits attributable to BancoPosta and cash and cash equivalents.

Composition of net financial position* (€m):

* Net financial position: (Surplus) / Net debt

* Net financial position: (Surplus) / Net debt

* * *

Declaration by the Manager charged with preparing the financial reports

The undersigned, Tiziano Ceccarani, in his capacity as the Manager in charge of preparing Poste Italiane S.p.A.’s financial reports

DECLARES

That, pursuant to Article 154 bis, paragraph 2, of the “Consolidated Law on Financial Intermediation” the information disclosed in this document corresponds to the accounting documents, books and records.

1 FIT (Federazione Italiana Tabaccai) is the association of licensed Italian tobacconists (former State Monopoly) counting 48,000 affiliates across Italy offering a range of services to the general public.

2 PuntoPoste is the dedicated eCommerce network offering access to 350 lockers nationally by the end of 2018.

3 Adjusted from IFRS15 and MCC-BDM

4 Adjusted from capital gains, IFRS15 effects and MCC-BDM

5 Relating to the deconsolidation of Banca Del Mezzogiorno – MCC for €50m and lower capital gains for €153m y/y and IFRS15 for €12m.

6 One-off release and one day less paid national holiday.

7 Total Financial Assets include technical provisions from insurance business, postal savings, customer deposits (including repos) and assets under management.

8 Revenues including gross capital gains (€404m in 1H18 vs €537 in 1H17).

Rome, August 2, 2018

POSTE ITALIANE 2Q & 1H 2018 FINANCIAL RESULTS – CONFERENCE CALL DETAILS

Rome, Thursday 2nd August at 10:30 CEST

+39 06 8750 0706 (Italy)

+44 (0)330 336 9411 (UK)

+1 323-794-2588 (USA)

+39 06 8750 0736 (Listen-only, Italy)

THE CONFERENCE CALL WILL ALSO BE AVAILABLE VIA LIVE AUDIO WEBCAST AT:

https://www.posteitaliane.it/en/presentations.html#/To see the press release in full version download pdf

For more information:

Poste Italiane S.p.A Investor Relations

Tel. +39 0659584716

Mail: investor.relations@posteitaliane.it

Poste Italiane S.p.A. Media Relations

Tel. +39 0659582097

Mail: ufficiostampa@posteitaliane.it

www.posteitaliane.it